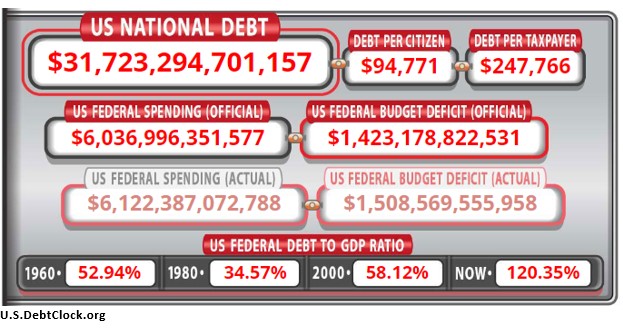

Here we go again. The US exceeded the current debt ceiling of $31.4 trillion back in January.

Since then, the Treasury has been paying the nation’s bills by using so-called “extraordinary measures,” taking money from other sources to meet the country’s obligations. However, those extraordinary measures are expected to be exhausted around June 1 – at which time the government will run out of money.

This happens every so often, as we all know, and the outcome is very predictable. The Democrats and Republicans always fight over how to raise the debt ceiling. The Democrats insist the debt ceiling be increased with no strings attached – just a simple vote to increase the limit. The Republicans always argue there should be some restrictions on government spending included in order to increase the debt limit.

The standoff always continues until the government is facing a default on its debt, and at that point both sides compromise and pass the legislation necessary to raise the debt ceiling. It’s like a broken record – we do it over and over again no matter who is in charge of Congress or the White House.

The threat of a US default on its debt is always unsettling to the financial markets, even though everyone knows what the ultimate outcome will be. This time will likely be no different. So, the markets are bracing for what will almost certainly be another political standoff in the weeks ahead.

Since 1960, Congress has increased the debt ceiling seventy-eight times, most recently in 2021. Forty-nine of these increases were implemented under Republican presidents, and twenty-nine were under Democratic presidents.

Congress can also choose to “suspend” the debt ceiling, or temporarily allow the Treasury to supersede the debt limit, rather than raise it by a specific amount. While this move was rare during the first ninety years of the ceiling’s existence, Congress has suspended the debt limit seven times since 2013.

Last month, the Republican-led House passed a bill that would suspend the debt ceiling in exchange for cutting federal spending by almost 14%. Analysts say the bill has no chance of passing the Democrat-led Senate, and Biden has threatened to veto the measure. So, the Republican deal is going nowhere – to no one’s surprise.

If Congress does not act to raise the debt limit by the time the extraordinary measures are exhausted around June 1, federal spending would have to plummet or taxes would have to rise significantly (or a combination of the two).

Many economists and policymakers believe the federal debt ceiling is an anathema to sound fiscal policy, calling it unwise to inhibit the government’s ability to meet already incurred financial obligations. In 2013, 97% of American economic experts convened by the University of Chicago agreed that the US mechanism for raising the debt ceiling can lead to worse fiscal outcomes.

Treasury Secretary Yellen falls into that camp, having argued the debt ceiling is inherently harmful to the US economy, because it functions primarily to restrict borrowing that finances the government’s previously incurred commitments.

Yet despite the fact that there is such widespread agreement the debt ceiling should be eliminated, nothing ever seems to be done to actually do so. We make a big deal of it every so often when the debt ceiling approaches; there is a fight between the two political parties; then a compromise is reached, the debt limit is raised and the issue is largely forgotten until the cycle repeats.

I don’t expect anything different this time around. Democrats and Republicans will drag their feet on the issue until the last minute. The financial markets will likely get nervous in the last days, which usually means the stock markets go down temporarily. Bond yields usually rise a little.

Then when the debt ceiling is raised, as it always is, things go back to normal. The debt limit impasse will be resolved before a single missed interest payment on government debt occurs because of public, political and financial market pressures on Congress reflecting concerns about the potentially severe consequences that a missed payment could have on financial markets and the economy.

So, in the weeks ahead as we approach the June 1 deadline, expect there to be a lot of bantering about whether to raise the debt ceiling, probably some nervousness in the financial markets, some ominous warnings in the financial media, but it will be nothing to be too concerned about.

Wash, rinse, repeat.

Sorry, comments are closed for this post.