On March 9, the Biden administration released its $6.9 trillion fiscal year 2024 budget request. At $6.9 trillion, it is the largest budget request in US history. That’s not surprising, though, as the budget goes up almost every year.

President Biden touted his latest budget saying it would be good news for most Americans. But the truth is, the record large budget is loaded with new tax increases which will burden virtually all Americans over time.

Today, we’ll examine the president’s latest budget proposal and expose why it’s just another government boondoggle Mr. Biden wants to foist on American taxpayers. Here goes.

Farmers, for example, know a thing or two about stewardship. If they don’t take care of their land, eventually it will cost them their livelihoods. Unlike farmers, who work to steadily build a better future, the Vikings of old would plunder villages, taking all they could carry away before moving on to their next target.

President Joe Biden’s budget takes the Viking approach, going after more and more of the American people’s hard-earned treasure every year.

Last year, his budget sought an additional $2.5 trillion in taxes beyond the $55.8 trillion in revenue that was forecast to be collected over 10 years. His latest budget for FY 2024 is even bigger. The president is calling for $65.2 trillion in taxes and other revenues—nearly $7 trillion more than his last mega-budget.

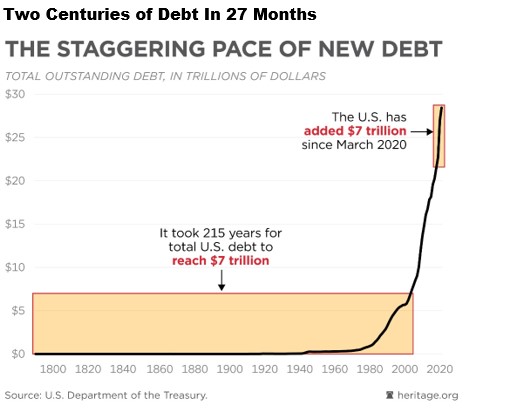

Yet even with all the new taxes, Biden’s budget would somehow still manage to spend $17 trillion more than it would collect over 10 years. This would shackle the American people with an additional $120,000 in federal debt per household by the end of the decade.

While the left portrays America’s billionaires as a bottomless well of tax revenues, the government could confiscate every penny of wealth from all the billionaires on the Forbes 400 list, seizing their companies’ assets and bankrupting them overnight, and that would barely cover half of Biden’s newest round of proposed tax increases. It wouldn’t even cover 5% of Biden’s total 10-year budget.

Clearly, all of Biden’s tax hikes can’t be limited to the very rich. Inevitably, they will reach the doorstep of nearly every working American.

The Biden budget document repeatedly boasts it is “fiscally responsible.” The truth is, it is unsustainable, and it would doom the middle class to massive future tax increases.

Biden’s budget includes across-the-board tax hikes by permitting most of the Trump individual tax cuts to expire. However, the biggest taxpayer raids would directly target upper- and upper-middle-income taxpayers. The collateral damage would be devastating and widespread, reducing investment, stifling entrepreneurship and leaving fewer good jobs for all Americans.

Biden’s budget includes across-the-board tax hikes by permitting most of the Trump individual tax cuts to expire. However, the biggest taxpayer raids would directly target upper- and upper-middle-income taxpayers. The collateral damage would be devastating and widespread, reducing investment, stifling entrepreneurship and leaving fewer good jobs for all Americans.

Biden’s proposed tax hikes on the upper middle class are a foreboding sign for the middle class. Biden’s raid on taxpayers would hit in several waves.

Under Biden’s plan, federal taxes on wages for upper- and upper-middle-income Americans would rise from 37% to 44.6%. If they invested some of their after-tax wages in stocks, they would face a 28% tax on any profits at the corporate level (up from 21%) and up to 44.6% tax at the investor level (up from 23.8%).

And that’s just the federal income taxes. Factoring in inflation and multiple layers of state and local taxes, many investors would be left with none or almost none of their investment gains after the government ransacking. It’s insulting that Biden refers to this as their “fair share.”

Small businesses—and those who rely on them—wouldn’t escape the wrath of Biden’s new taxes either. Currently, small business active income is exempt from the net investment income tax, a surtax applied to investment income. Biden’s plan would extend this tax to directly hit most small business income and would raise the surtax from 3.8% to 5%.

Even death may not protect business owners from Biden’s new taxes. The president’s proposal would nearly triple the number of taxpayers subject to the 40% death tax in 2026. If the deceased owned a business, the tax would apply to any increase in the value of a business since it was started or acquired. These changes would punish families for experiencing tragedy and force more owners of family businesses and farms to liquidate their assets to pay the steep taxes.

When businesses and farms are ruined, it’s not just the owners who suffer. Store clerks, janitors and laborers across the board will struggle to put food on the table when their employers go out of business.

For too long the president and Congress have treated taxpayers as though they should be allowed to keep only what the government decides, as though taxpayers serve at the pleasure of the government. This is precisely backward.

The government exists—at the consent of the governed—to defend us against threats to life, liberty and property, not to take our liberty and property.

Sorry, comments are closed for this post.