The US economy as measured by Gross Domestic Product rose 2.1% in 2022. While that was down from the red-hot pace of 5.9% in 2021, 2.1% growth is still a solid number. The question is, what happens in 2023?

Most forecasters continue to predict we’ll see a recession later this year. The only question in their minds is how severe it will be. They have held this view for some time even though the economic data has held up better than expected. Let’s look at some recent economic numbers in no particular order.

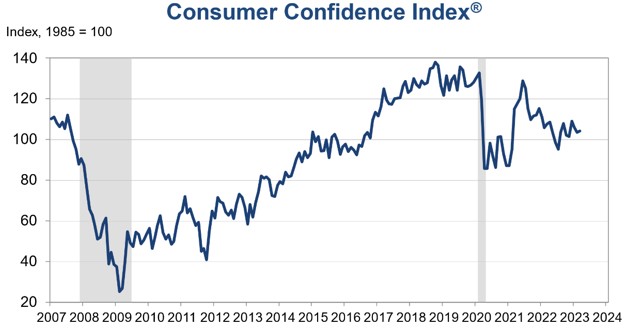

Consumer confidence ticked up slightly in March, despite the recent bank failures, but is still below the average level we saw in 2022. Consumer spending fell 0.4% in February after rising a stronger than expected 3.2% in January. Retail sales fell 1.0% in March following a decline of 0.2% in February.

Sales of existing homes rebounded in February after weakening late last year and in January. Ditto for new homes sales. New orders for durable goods fell 1.0% in February following a much larger decrease in January.

Auto sales were a bright spot which jumped 9.5% in February, well above the pre-report consensus expectation. The number of people flying in the US has rebounded to pre-pandemic levels this year and is growing.

As you can see, some of our best indicators of consumer confidence and spending are a mixed bag but are not pointing to a recession just yet. With consumer spending accounting for two-thirds of GDP, we’ll need to watch this closely in the months just ahead.

As regular readers know, I have not been in the “recession just around the corner” crowd this year. I just have not seen it in the economic data released so far in 2023. Of course, while consumers can pull in their horns and cut back spending significantly at any time, I currently don’t see this as the most likely scenario just ahead. We’ll see what happens.

Will Inflation Continue Falling?

Inflation as measured by the Consumer Price Index (CPI) surged to 9.1% last summer, the highest level in decades, to the surprise of just about everyone. The CPI has since subsided somewhat. For the 12 months ended March, the CPI rose 5%, with the decline driven largely by falling energy prices.

The question is whether the CPI will continue to fall, as the Fed hopes, or will it stabilize at the current level, or will it go back up again. Most forecasters predict inflation will continue to fall to a range of 2.8% to 3.5% this year, but no predictions I read suggest the CPI will fall back to the Fed’s target of 2%. I agree. This remains to be seen, of course.

The drop in the CPI in March was largely due to these factors. Shelter prices, the biggest single component in the index, slowed their rate of increase to 0.6%, from 0.8% the previous month, and are expected to slow further.

The prices of other services slowed their rate of increase a tick, to 0.4%. The price of groceries declined modestly, their first price drop in almost three years. Meat prices edged down, and egg prices have fallen 17% over the past two months. Energy prices dropped 3.5%, with the biggest decline in natural gas.

The recent surge in clothing prices eased, and goods prices in general showed only a modest increase. Used car and truck prices declined for the ninth consecutive month. The large jumps in airfares and hotel rates in March are part of the normal rebound in these prices after the pandemic but are not expected to be sustained.

Price increases in services remain stubbornly high, as wage gains that drive up business operating costs are proving slow to moderate. This is likely the reason why price increases at restaurants have not slowed, for example.

Excluding food and energy, so-called “core inflation” is still at 5.6% and may stay above 5% for the rest of the year. Price increases of new vehicles strengthened in March, and prices of used vehicles are also expected to jump in April and May. Gasoline prices are increasing in April because of oil production cuts by OPEC.

The bottom line is that while overall inflation looks likely to continue to tick down further, it is very unlikely to fall to the level the Fed wants it. This suggests the Fed will continue to hike short-term interest rates just ahead.

I expect at least a couple more interest rate hikes this year, most likely at the next two Fed policy meetings on May 2-3 and June 13-14. Following that, I agree the most likely scenario is for the Fed to pause its rate hikes for awhile and see what happens.

Is tax revenue coming in WAY low? Will this push the debt limit deadline forward quicker? Where does a U.S. citizen hide their money and maintain their purchasing power? Will rates have to rise faster to keep from default?

Aren’t wages very vary sticky? What is a poor soul on fixed income suppose to do?