Some of you may not be aware of this, but there is a big push in developed countries around the world to switch to a “digital” currency. Digital currencies would allow governments and their central banks to track all purchases by their citizens and would thus be a major intrusion of our privacy.

Fortunately, efforts to replace existing currencies with new digital currencies have met with stiff opposition from consumers and advocacy groups around the world. As a result, it doesn’t look like efforts to switch to new, trackable currencies will be successful anytime soon. That’s the good news. Specifically, the US dollar is not going to be replaced as so many fearmongers have warned over the years.

While it’s good to know the threat of a digital currency is waning around the world, it is important that we all understand it and communicate to our elected officials that our position is: We clearly don’t want to switch to a new currency. The current US dollar is just fine, thank you. Most governments and central banks appear to have accepted this reality, at least for now.

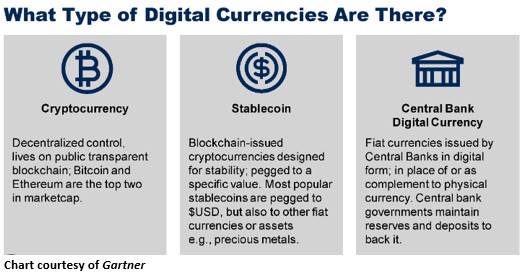

So, what is a Central Bank Digital Currency (CBDC) anyway? A CBDC is a digital form of a national currency issued or coordinated by a nation’s central bank. Unlike paper or a private decentralized digital currency, a CBDC leaves an electronic trail of purchases and sales within a government digital ledger. Ledgers of such information are in the hands of governments that in many cases have a dark history of abuses of civil liberties.

Proponents say CBDC would lead to faster payments that would particularly benefit lower-income individuals. Yet critics argue the mechanism for CBDCs is ripe for abuse, allowing the government to violate financial privacy and reward and punish certain behaviors by controlling access to digital money.

Measures of public reaction in the US and elsewhere show that the general public — as well as a growing number of their representatives in their governments — are firmly on the side of critics of CBDCs. Americans are generally skeptical of grand new government initiatives. According to a recent Pew Research poll on faith in the American government, only 20% of the public currently trust the government. This is near a record low.

Beyond general mistrust of government, Americans seem to specifically distrust the government wielding its powers with a CBDC. Most people don’t see a need for it, with just 16% supporting a Federal Reserve-controlled digital currency, according to a recent CATO Institute poll.

Europe is facing skepticism, as well. A growing number of members of the EU Parliament are saying they do not see any added benefit to a CBDC. Markus Ferber, the economic spokesperson for the center-right European People’s Party, put it this way: “There’s one central question which hasn’t yet been credibly answered, which is what is the added value … what can I do with a digital euro that I can’t do with current payment options?”

In the US, lawmakers are introducing anti-CBDC legislation that should be a model for the world. In the US House of Representatives, Rep. Alex Mooney (R-WV) introduced the “Digital Dollar Prevention Act” in June, which prevents the Federal Reserve from committing to any programs involving the development of a CBDC without the express approval of Congress.

While House Majority Whip Tom Emmer (R-MN) earlier introduced a bill restricting Fed issuance of CBDCs, Mooney’s bill takes it further, expressly banning “pilot programs” that could create CBDCs indirectly through public regulatory states and the private sector.

More must be done overall to protect civil liberties and the stability of the American free market from the destructiveness of a CBDC. We need bipartisan efforts to protect financial privacy and oppose policies that go beyond the wishes of the governed. A central bank issuing a digital currency by the US is unwise and would further erode existing financial freedoms.

For all those reasons and others, let’s just say NO.

Thank you, Gary, for your opposition to CBDCs. Such a currency would not only be the absolute end of privacy, it is the autobahn to complete government control of the public. The government can turn off access to your money easily and also control what you are or aren’t allowed to spend it on. It would be the dream of every totalitarian on the planet and I fully agree that it must be stopped at all costs.

Will we be able to say no to this…without a penalty?

What keeps the government from enacting this via executive order or some other non-democratic means?