For the last few weeks, President Biden and his top advisors have launched his re-election campaign and have been crisscrossing the country touting what they say are the president’s many economic successes since he took office. They claim Mr. Biden’s policies – which they refer to as “Bidenomics” – have created millions of jobs, taken millions out of unemployment lines and caused the unemployment rate to fall to the lowest level in nearly 50 years.

At the same time, the Biden administration has committed trillions in new government spending programs and is running massive deficits in the process. They want us to believe this is the best economy in years. The American people are not buying it – 74% believe the economy is headed in the wrong direction, according to the latest NBC poll.

Even worse, recent government surveys reveal millions of working Americans believe they are worse off than they were in January 2021 when Biden first entered the White House.

The US Census Bureau regularly conducts what it calls “Household Pulse Surveys.” Among other things, the Household Pulse Surveys (HPS) asks respondents about spending and debt, loss of employment, anxiety and the effects of natural disasters.

One of the most important questions included in the HPS asks Americans about their “difficulty paying for usual household expenses.” In a truly healthy, growing economy, fewer – not more – working Americans should say that they are having less trouble paying their “usual” bills. But the exact opposite has occurred.

In January 2021, the first month of Biden’s presidency, an estimated 80.53 million Americans found it “somewhat” or “very” difficult to pay their household expenses. According to the most recent HPS survey, conducted in July 2023, that number soared to 86.92 million, an increase of more than 6 million.

This means in Biden’s America, more than 1 in 3 households are struggling to pay their bills.

The income brackets most affected are those earning $50,000 to $150,000, many of whom would be considered part of America’s “middle class.” The number of households earning $50,000 to $75,000 that are having trouble paying their usual household expenses increased from 10.01 million in January 2021 to 13.34 million in July 2023.

The HPS survey data further suggests that Americans having trouble covering their costs are turning to credit cards, personal loans and other forms of debt for relief. In July 2023, 85.46 million Americans relied on “credit cards or loans to meet spending needs in the last 7 days.” In July 2022, the number was just 74.89 million.

A growing dependence on credit cards is particularly troubling considering that the credit card delinquency rate – which measures the proportion of credit customers who have fallen behind on their bills – has increased in each of the past seven quarters and is now higher than it was before the pandemic started. Auto loan delinquencies in the second quarter of 2023 also topped pre-pandemic levels.

The HPS surveys aren’t the only data suggesting working Americans are suffering under Biden’s economic agenda. A LendingClub report published earlier in 2023 found that 61% of Americans say they are living paycheck to paycheck. In cities, the number is even higher, coming in at 69%.

Equally concerning, 57% of Americans say they can’t afford to cover an emergency expense of $1,000 or more – much less than the cost of many families’ health insurance deductibles.

Although many left-wing pundits act as though the current state of the economy is nothing short of a modern golden age of economic prosperity, the evidence is overwhelming that Democrats’ reckless spending programs and expansion of the size and influence of government have caused significant harm to millions of families.

The source of the problem is not hard to pinpoint, either. Democrats have spent trillions upon trillions of dollars without offsetting the increase with additional tax revenue, effectively printing huge amounts of money.

To be fair, I must concede that Republicans, were they in control, would have also increased spending, as they proven in recent years they can spend with the best of ‘em.

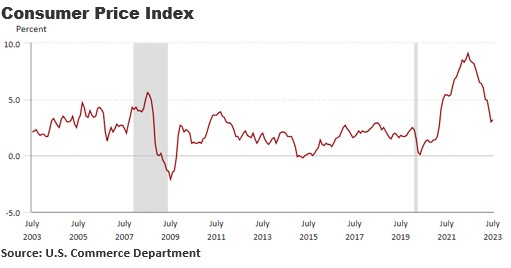

In any event, those huge spending increases have created soaring inflation. While inflation has come down some in recent months, it still remains well above the government’s target and where it has been over the last 15 years or so.

As a result of their inflationary policies, prices for almost everything are higher now than they were just a few years ago. To purchase the same items that collectively cost $200 in January 2019 would cost consumers $243 today, and that’s using deeply flawed CPI numbers which fail to fully account for inflation in huge swaths of the economy.

The average price of unleaded gasoline is up 53% compared to when Biden first took office. The price of a gallon of milk increased by 23% from 2020 to the end of 2022. The average sales price of a home is more than $120,000 higher today than it was at the start of the pandemic.

The results speak for themselves. Higher costs, struggling families and more debt – that’s what Bidenomics really looks like.

Sorry, comments are closed for this post.