President Joe Biden officially kicked off his 2024 re-election campaign in August, and he has been crisscrossing the country with campaign stops since then. His main re-election pitch is that the US economy is surging as a result of his economic policies.

On that subject, the president repeatedly touts that the US economy has added almost 13.5 million new jobs since he took office in January 2021. If true, that would be more jobs than created by any previous president over four years.

The question is: Is it true? The answer is a little complicated but I’ll sort it out for you below. The fact is, nearly 13.5 million jobs have been gained since Mr. Biden took office. But what is critical to realize is that the vast majority of those new jobs were simply businesses which shut down during Covid and are now reopening – and calling back their laid-off workers.

The issue when it comes to President Biden claiming he has created a record 13.5 million jobs since he took office is whether he should get credit for those workers being called back to their old jobs because their former employers are simply reopening. I say NO!

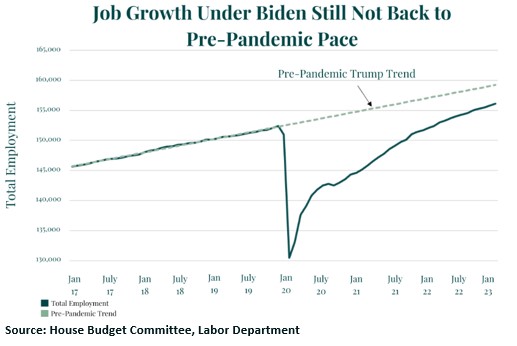

Let’s look at the actual jobs numbers from the House Budget Committee and the Labor Department. Of the 13.5 million jobs gained since Mr. Biden took office, nearly 72% of those were simply jobs that were being recovered from the pandemic, not new job creation.

In fact, when looking at today’s economy compared to pre-pandemic levels, employment is up only by 3.7 million under Biden. By comparison, prior to the pandemic, job creation under President Trump was 6.7 million — 3 million more jobs than the current President.

So, the next time you hear President Biden claim that 13.5 million new jobs have been created on his watch, just know that he is lying. Almost 10 million of those jobs came from businesses that closed during the pandemic and have been merely reopening and rehiring workers which were laid of in 2021 and 2022.

The fact is, millions of American families are in serious financial trouble. A recent Morning Consult survey found that in the third quarter of this year only 46% of Americans could cover a $400 unexpected expense without going into debt.

It shows how expenses as commonplace as a surprise car repair or a medical bill are forcing many American families into debt – at a time when interest rates are disturbingly high.

The Lending Club’s “Paycheck-to-Paycheck Report” for June confirms the Morning Consult survey noted above. It found that a majority of Americans (54%) were living paycheck to paycheck. That includes 53% of consumers who earn $50,000 to $100,000 per year. So, this problem extends well beyond lower-income families, although it certainly hits you harder the less money you have.

But what about personal savings? Americans received a lot of cash from the government during the pandemic. In fact, when Biden took office, Americans had $2.3 trillion in personal savings. That number shot up to $5.7 trillion following Biden’s March 2021 legislation ironically named the “American Rescue Plan.”

But by June of this year, a mere 27 months later, personal savings had dropped by nearly $5 trillion to a much diminished $862 billion.

Again, it isn’t just lower-income Americans who have watched their savings diminish. According to a Bloomberg analysis, the average middle-class household has lost over $33,000 in real wealth in just the past year. That’s huge!

The situation is so bad that many Americans are even draining their 401(k) plans to cover expenses. According to Bank of America’s analysis of its clients’ employee benefits programs (with a total of over 4 million plan participants), 36% more people drained their retirement accounts to make ends meet in the second quarter of 2023 as compared to the same period last year.

So, where did all that money go? Well, you may have noticed that Bidenomics-induced inflation has driven the cost of living up – a lot. Let’s look at it in dollar terms, which is how most Americans experience inflation.

The Bureau of Labor Statistics publishes the Consumer Price Index (CPI) each month, a common measure of inflation. CPI takes a basket of commonly purchased goods and services and prices them on a monthly basis. In January 2021, when Biden took office, that basket cost about $261.50. In July of this year, the same basket cost $305.70. That’s a huge 16.9% increase in only two and a half years. It’s also larger than the CPI increase for any full four-year presidential term since the 1980s, and Bidenomics has 16 months to go.

Exacerbating the problem, wage growth has failed to keep pace with inflation – increasing only 13% since Biden took office (versus nearly 17% for inflation). When you’re living paycheck to paycheck, as over half of Americans are, that kind of disparity hurts.

The bottom line is: Bidenomics is not working out well for at least 54% of American families, as reported by Lending Club. It’s not working well for the other half of families not living paycheck-to-paycheck either. Most Americans know this.

Still, the Biden campaign said this week it plans to tout Bidenomics from now to election day in 2024. That’s not a winning argument in my opinion!

Sorry, comments are closed for this post.