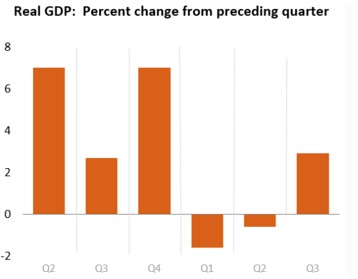

The Commerce Department reported yesterday that 3Q Gross Domestic Product rose at an annual rate of 2.9% following its initial estimate of 2.6% last month, as you can see in the chart below. The latest 2.9% print was better than expected.

Most forecasters are hesitant to issue predictions for the 4Q of this year due to uncertainty over how much more the Fed plans to raise interest rates going forward. I’ll have more comments on the Fed below, following Fed Chairman Jerome Powell’s comments in a speech yesterday.

Most forecasters are hesitant to issue predictions for the 4Q of this year due to uncertainty over how much more the Fed plans to raise interest rates going forward. I’ll have more comments on the Fed below, following Fed Chairman Jerome Powell’s comments in a speech yesterday.

Economists who have weighed in expect the economy to eke out modest 1% annualized growth in the 4Q, according to a survey of forecasters conducted by the Federal Reserve Bank of Philadelphia. The nation’s manufacturing sector is still slowing despite an easing of supply chain problems which have backlogged production since the economy began rebounding from the pandemic recession two years ago.

And most forecasters worry that high inflation could weaken the crucial holiday shopping period. Retailers say inflation-weary shoppers are shopping cautiously, with many holding out for the most attractive bargains.

Despite that, the latest figures on the health of the US economy show the economic picture looks considerably rosier than it did in the first half of the year when GDP declined slightly. The latest GDP reading of 2.9% was four-tenths of a percent higher than what had been expected, and the fastest growth in two years.

The latest GDP report, plus others I will cite below, point to a resilient if slow-moving economy, led by steady hiring, plentiful job openings and low unemployment. Wednesday’s government report showed that the restoration of growth in the July-September period was led by solid gains in exports and consumer spending which were slightly stronger than originally reported.

In addition to the good GDP news, the widely-followed University of Michigan’s Consumer Sentiment Index rose to 56.8 in November, following 54.7% in October. The Consumer Confidence Index remained firm at 100.2 in November, although it was down slightly from the October reading.

New home sales rose more than expected in October at 632,000 units, up from 588,000 the previous month. Durable goods orders rose more than expected in October to 1.0%, up from 0.3% in September.

Not all the economic data of late was positive, of course, but let’s hope good news like the above continues!

Fed Chairman Powell Remains Hawkish But Increases To Slow

In a speech yesterday at The Brookings Institution, Fed Chair Jerome Powell indicated that short-term interest rates will continue to move higher as the Fed tries to get inflation under control. However, Mr. Powell said the Fed is considering “moderating” the of size of Fed Funds rate increases going forward.

The Fed has raised its key Fed Funds rate five times this year following each Fed policy meeting, each time by raising the rate 0.75%. The rate has gone from near zero at the beginning of this year to 3.75% presently. The Fed’s next policy meeting is on December 13-14.

In light of Mr. Powell’s comments yesterday, it is now expected that the Fed will raise its interest rate by only 0.5% (50 basis points) this month.

Inflation, as measured by the Consumer Price Index, rose just above 9% earlier this year. The CPI has since fallen to 7.7% as of October but is still far above the Fed’s target of 2%.

The question, of course, is how much higher do interest rates have to rise in order to slow the economy enough to reach the Fed’s inflation target of 2%? This is a matter of great speculation and opinions vary greatly. Here’s mine.

First of all, I do not believe the Fed will be successful getting inflation down to 2%. I maintain that doing so would almost certainly mean a serious recession. So, I expect the Fed to halt its interest rate hikes next year and settle for inflation of 3-4% to avoid sparking a nasty recession. I could be wrong, of course.

As noted above, the Fed is expected to slow its Fed Funds rate hike to 50 basis points this month, and probably another 50 basis points at its next meeting on January 31/February 1. What the Fed does beyond that is highly uncertain. It could raise by another 50 basis points at its March 21-22 policy meeting, or it could drop back to 25 basis points going forward.

What is clear is the Fed is still very determined to get inflation down significantly and this means at least several more interest rate hikes going well into 2023. The only question now is whether the Fed can get inflation down to a reasonable level without throwing the US economy into a recession next year. I would put the odds at 50-50 at best. Only time will tell.

Sorry, comments are closed for this post.