Most major CEOs believe a recession is coming later this year or next, and they aren’t buying the notion that the US economy will have a soft landing following a series of historically large interest rate hikes by the Federal Reserve to fight inflation.

According to a survey of 400 leaders of large US companies by consulting firm KPMG, a whopping 91% are predicting a recession in the next 12 months. What’s more, the survey, which was released on Tuesday, found that only 34% of these CEOs think the recession will be mild and short.

“There has been tremendous uncertainty over the past two and a half years,” said Paul Knopp, chairman and CEO of KPMG US, referring to the Covid-19 pandemic and worries about inflation. “Now, we have another looming recession.”

Companies are preparing for a downturn and planning to cut expenses. A big way to slash costs? Job cuts. KPMG noted that more than half of the CEOs are considering workforce reductions to deal with a recession.

But there are some (slightly) hopeful signs.

Even though a majority of CEOs think the recession will be more than just a modest pullback, many C-suite execs believe their companies are in stronger shape now to deal with such a harsh economic reality than they were in 2008.

“There is optimism for the longer-term about the US economy and the prospects for their own organizations,” Knopp said. “Companies see themselves as more resilient and better prepared.”

It’s also worth noting that companies recently dealt with a sort of dress rehearsal for a downturn when the economy briefly dipped into a recession two years ago during the onset of the pandemic. The unemployment rate soared to a record high of 14.7% in April 2020.

But Knopp said CEOs are clearly nervous enough about the short-term prospects for the economy that they intend to make changes to some longer-term spending plans. One area in particular that could get hit is investments in environmental, social and governance initiatives, or ESG.

Knopp noted that even though many CEOs said they believe their businesses will improve over the long-term due to ESG, they may need to pause some of these efforts over the next year or so in order to keep costs down.

He added that businesses realize there are potentially even greater risks from cutting too many jobs and reducing spending too heavily. This is important and is why I don’t believe a recession will be severe.

“Companies can’t overreact in the short term because that can create problems for the long-term. The pandemic has still created pressing concerns for companies,” Knopp said. “Companies hope that there will be a quick takeoff in the economy again after a slowdown.”

Knopp said CEOs are also going to be paying very close attention to the midterm elections and the political landscape in Washington more broadly before setting any long-term investing plans.

“There is real uncertainty about the outcome of the midterms and potential for tougher tax legislation and increased regulations,” he cautioned.

The worries among leaders of top companies are apparently shared by the heads of smaller companies, too.

A survey of mid-market companies conducted last month by accounting and advisory firm Marcum LLP and Hofstra University’s business school showed that more than 90% of CEOs of midsized companies are concerned about a recession. More than a quarter of these CEOs said they have already begun layoffs or plan to do so within the next 12 months.

These views of a coming recession by corporate CEOs are also shared by a majority of American investors. In fact, more than half of Americans – 56% – think the country is already in a recession, according to a recent survey from Mass Mutual.

The same survey found that 80% of Americans are worried about how a recession could affect their daily finances. The Mass Mutual survey was taken in late August.

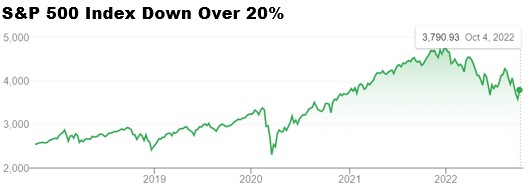

With the S&P 500 Index down over 20% this year, many investors are considering whether now is a good time to jump back into the equity markets. The problem, as always is, no one knows if the market has bottomed. So, as usual, most will do nothing and miss the next major upturn in the stock markets.

Finally, I’ll finish with some good news: As I will report in Forecasts & Trends next Tuesday, stocks have rallied following the mid-term elections in every cycle since 1950. That’s an incredible feat! This is why you want to get positioned well before the November 8 elections.

You can subscribe to Forecasts & Trends by clicking on this link, so you don’t miss my commentary and analysis next week. FYI, I’ve been writing my newsletter continuously for over 40 years. I write about the economy, the markets, investments and often-times just whatever I find most interesting, including politics.

Remember, Forecasts & Trends is free of charge. You definitely want to see what I have to say next week, so please join us!

Sorry, comments are closed for this post.