We just had the strongest economy in 40 years in 2021 when GDP grew by 5.7%. Wages grew by 4.7% on average last year, also the strongest annual growth in many years. Yet a new poll from Issues & Insights/TIPP in March found that only 20% of Americans said they were better off financially after last year, while another 42% said they were worse off, and another 36% said they were about the same.

So, in the best year for the economy in 40 years, only one in five Americans said they were better off, while 78% of Americans said they were worse off or about the same. What gives?

Sharply higher inflation is what gives. Despite the strongest annual wage growth in decades last year, prices for goods and services we all buy rose even more. Inflation rose 7% last year to its highest level in four decades, as supply chain disruptions and labor shortages collided with growing demand from US consumers. Gas prices are up 50% from a year ago, while the price of meat, fish and eggs is up nearly 13%, according to the US Consumer Price Index.

If you take the average pay increase of 4.7% and subtract it from the 7% average inflation rise of 7%, you get an average pay cut of 2.3%. No wonder so many Americans don’t feel they are better off after last year’s wage increases!

Whether this is his fault or not, all this has occurred on President Biden’s watch. His slumping poll numbers are a reflection of this reality. Mr. Biden’s economic approval numbers are the lowest since President Jimmy Carter’s at this point in his presidency in 1977.

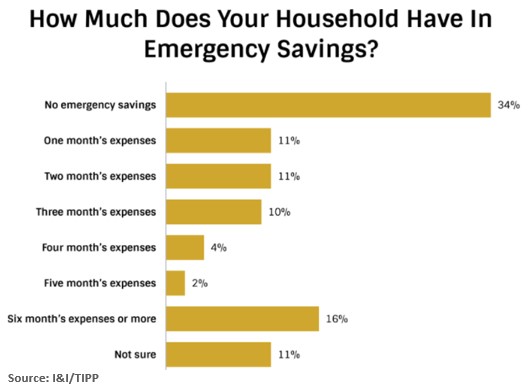

And the numbers get even worse from there. In the same poll, I&I/TIPP also asked Americans, “How much does your household have in emergency savings — that is, money that is readily available in either a checking, savings or money-market account?”

Respondents were given eight possible responses: “No emergency savings,” “One month’s expenses,” “Two months’ expenses,” “Three months’ expenses,” “Four months’ expenses,” “Five months’ expenses,” “Six months’ expenses or more,” and “Not sure.”

Sadly, the biggest category by far was “No emergency savings,” at 34%. Both “One month’s” and “Two month’s” garnered only 11% each.

So, 56% of all Americans, over half of the population, have either no savings or barely enough to last two months, should economic trouble occur. For most, that means they are one job loss or personal injury away from economic disaster.

Only 16% of respondents said they had financial resources for three to five months. And just 16% responded they had enough stashed to last for six months or more. Another 11% said they “weren’t sure,” perhaps the most worrisome response of all.

The Economy Is Headed For Tough Times In 2022

While the US economy enjoyed the strongest growth in decades last year, we appear headed for a significant slowdown later this year. President Joe Biden loves to blame our sky-high inflation on corporate greed and Vladimir Putin. But a new study from the San Francisco Fed shows it was Biden himself who put America on this grim inflationary trajectory.

Specifically, it was the massive $1.9 trillion stimulus dumped into the US economy in early 2021 by the president’s American Rescue Plan.

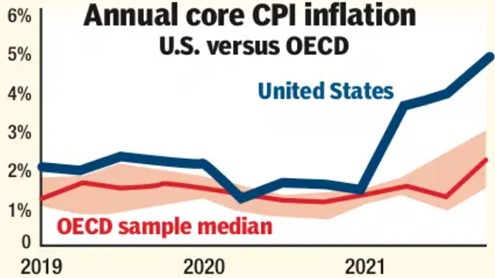

As the chart below shows, the nation began heading into the inflationary stratosphere in early 2021, while other advanced economies in the Organization for Economic Cooperation and Development (OECD), haven’t seen anything like the soaring prices now punishing workers across America.

Which means the spike is due to something US-specific, rather than global prevailing conditions. That policy was, of course, Biden’s signature economic “achievement.”

The damage it did has been huge. While median OECD inflation went from around 1% to 2.5% during 2021, the US went from under 2% to 7% (5% excluding food and energy). And it kept on rising after that, to the nearly 8% we see now. The details are uglier still: Per the latest data, for example, fuel oil is up almost 44% and gasoline is up 38%.

Put in concrete terms, a recent Bloomberg calculation translates this to an added $433 per month in household expenses for 2022.

And wholesale prices are up even more. The Producer Price Index jumped a shocking 0.8% in February and is up 10% over the last 12 months, meaning even more pain ahead.

It was utterly unnecessary: Biden’s stimulus was pure political favor-currying dumped into an economy already overheating on the demand side. Little of it had much to do with the COVID relief it claimed was the point.

Also, while Biden’s move didn’t officially happen until March and inflation was heading up before that, he was clearly signaling from the start of his administration what he was going to do, thus opening the floodgates.

The Biden White House, despite being proved wrong over and over on the economy, is sticking to its guns – still talking about “Putin’s price hike” and stupidly tapping our Strategic Petroleum Reserve by a record amount instead of getting out of the way and letting America move back toward energy independence.

So, be prepared for even more inflation later this year.

Sorry, comments are closed for this post.