On February 1, the Treasury Department reported that the US national debt surpassed $30 trillion for the first time – a figure that’s incomprehensible in the best of times, let alone when many Americans are still dealing with the economic impact of the coronavirus pandemic.

But as usual, nobody cares. The mainstream media barely mentioned it, if at all, and most Americans have no idea how big our gargantuan national debt is – or the fact that it is unquestionably impossible we’ll ever pay it off.

The only way our national debt goes away at this level is by DEFAULT, which is almost certain to happen at some point. We just don’t know when. Here are the latest numbers on the debt:

Keep in mind our national debt only consists of “debt held by the public” and “intra-governmental debt.” Debt held by the public, currently at apprx. $24 trillion, is government debt held by individuals, corporations, investment funds, the Federal Reserve, foreign governments, etc. Intra-governmental debt, currently at apprx. $6 trillion, is debt various US government agencies owe to each other, but it is still outstanding debt which must be rolled over or repaid at some point.

Our real national debt, if we include such obligations as unfunded pensions for our 10+ million federal workers (including military and contract workers) is much, much larger. Our total national debt is now estimated at $86.5 trillion but nobody ever talks about this, even though we do in fact owe and will have to pay it, and much more, over time.

Before I move on from these debt charts, turn your eyes back to the top chart above. Look at the figure immediately to the right of “U.S. National Debt” of just over $30 trillion. Look at the box with the heading “Debt Per Citizen” which as you can see reads $90,291.

This means for us to pay off our $30+ trillion national debt today, every man, woman and child in America would have to contribute $90,291. Let that soak in. This is why I continually say it is impossible we ever repay our debt. How many people do you know with an extra $90K laying around they could give the government to pay off our national debt? Very few, I’ll bet!

So, how has our spending gotten so out of control in recent years? Simple: the government has spent record amounts of money, directly or indirectly, to fight the COVID pandemic. Take a look at the recent annual federal budget deficits. The government ran a record deficit of $3.13 trillion in fiscal year 2020 and another $2.77 trillion in FY 2021 which ended September 30.

When pressed on the matter of runaway deficits, most politicians in Washington say spending over the last two years was unprecedented due to the pandemic, and it will fall significantly as we get back to “normal” – whatever that is.

Wrong! The Biden administration’s official budget request for FY2022 was for an increase of 8.6% over FY2021. Is that getting back to pre-pandemic normal? NO!

US Households Added $1 Trillion In Debt In 2021

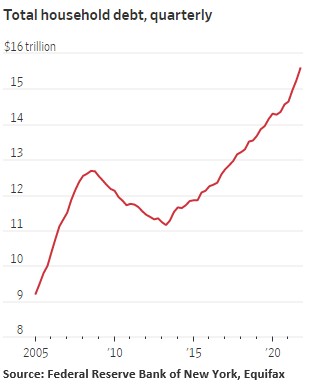

Americans took on more new debt in 2021 than in any year since before the 2008-09 financial crisis. Total household debt rose by $1.02 trillion last year, boosted by higher balances on home and auto loans, the Federal Reserve Bank of New York reported Tuesday. It was the largest increase since a $1.06 trillion jump in 2007.

Total consumer debt now sits at around $15.6 trillion, compared with $14.6 trillion a year earlier. This is the largest amount of consumer debt ever recorded.

The increase is largely a function of a sharp rise in prices for homes and cars. US home prices rose nearly 20% on average 2021, boosting mortgage balances and pricing out many middle-class buyers. Rising prices for new and used cars drove auto-loan originations to a record $734 billion last year, with used car prices up 40% in many cases.

The increase is largely a function of a sharp rise in prices for homes and cars. US home prices rose nearly 20% on average 2021, boosting mortgage balances and pricing out many middle-class buyers. Rising prices for new and used cars drove auto-loan originations to a record $734 billion last year, with used car prices up 40% in many cases.

Americans added $52 billion to their credit card balances in the fourth quarter, the largest quarterly jump on record, the New York Fed said in its latest report on household debt and credit. The bottom line: Americans added a record level of debt in 2021.

Economists at the Federal Reserve Bank of New York claim the rise in consumer borrowing isn’t necessarily cause for alarm since wealth increased across all income levels during the pandemic. And delinquency levels on consumer loans are still hovering around record lows.

What’s more, they say, some 87% of the new debt is tied to homes which can appreciate over time, allowing borrowers to build wealth. Today’s home buyers also are in better financial shape. Subprime borrowers, who are considered higher risk, accounted for just 2% of the mortgage debt originated in the 4Q of 2021, down from 12% in the years before the financial crisis.

While some economists at the Federal Reserve may feel the record increase in household debt is not worrisome, their confidence is largely based on the economy remaining strong (no recession). Yet the current economic expansion is the longest in modern times, and we are overdue for a recession.

As investors we should all keep in mind that the record increase in debt last year will come back to haunt us if the economy slows significantly, or worse, we hit a recession. That’s why I wanted to make sure my clients and readers know about this.

Sorry, comments are closed for this post.