The Commerce Department reported earlier this month that real wages continued to fall in August, thereby pinching Americans’ buying power. Since consumer spending makes up apprx. 70% of Gross Domestic Product, the decline in wages explains in part why our economic recovery is so weak. GDP grew by only 0.4% in the 1Q and 1.0% in the 2Q.

Source: Investor’s Business Daily

Inflation-adjusted weekly earnings have fallen significantly in recent months, likely falling more than 1.5% vs. a year earlier in August. That would be the biggest drop since the height of the financial crisis in late 2008.

The Bureau of Labor Statistics reports that there are more than four people available for every job opening, and that has put intense pressure on wages since the peak last October. Some 40% of the unemployed have been out of work for more than six months, and many are desperate to find a job. Average weekly wages have now retreated to $350 as shown above.

Real disposable income per capita is considered by many researchers to be the single most important factor in Americans’ sense of well-being. It can also affect their voting patterns, which doesn’t bode well for political incumbents.

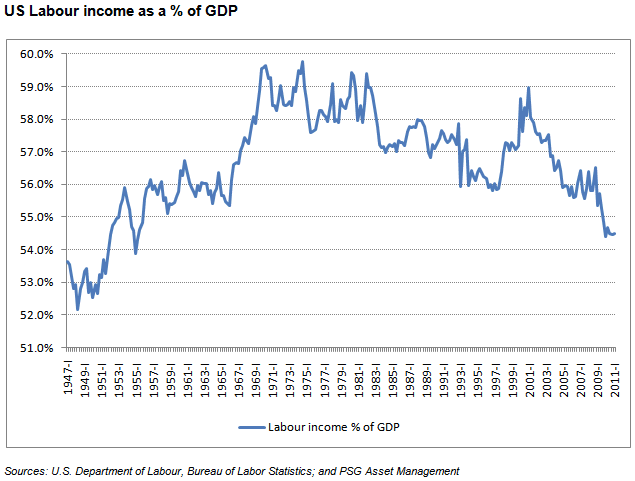

The following chart shows labor income as a percentage of GDP. As you can see, this percentage has been falling for decades due primarily to increased productivity, new technologies and outsourcing jobs abroad. The decline from the last peak in 2000 has been quite severe, putting it back to levels not seen since the mid-1950s.

Will Obama’s New Stimulus Plan Help?

The President’s $447 billion stimulus plan calls for payroll tax cuts, which accounted for more than half of the plan, extension of emergency unemployment compensation, infrastructure spending, aid to state and local governments, programs to subside the issue of long-term unemployment and mortgage-refinancing assistance. The $447 billion package is equivalent to nearly 3% of GDP, so it could provide a minor boost to economic growth next year.

But Obama has a problem: Congress is not likely to give him remotely $447 billion to spend. The latest Rasmussen poll over the weekend found that only 38% of likely voters approve of the President’s plan, while nearly as many (36%) oppose it, and 26% are uncertain. Among Democrats, 66% favor the plan, while 64% of Republicans oppose it.

I will have a lot more to say about President Obama’s new stimulus plan in my weekly E-Letter tomorrow, including the fact that he lied about the stimulus being “fully paid for.”

Economic Reports This Week

| Tues – Producer Price Index (Aug) | Consensus 0.0% |

| Tues – Retail Sales (Aug) | Consensus 0.2% |

| Wed – Initial Unemployment Claims | Consensus 410,000 |

| Thur – Consumer Price Index (Aug) | Consensus 0.2% |

| Fri – Industrial Production (Aug) | Consensus 0.0% |

| Fri – Michigan Consumer Sentiment | Consensus 56.3% |

Hilarious Take on Obama Stimulus Speech!

Click here to see a hilarious take on the Obama Stimulus Speech!

*Warning: Obama fans may not find it so funny.

Welcome New Readers!

If this is your first visit to my Between The Lines blog, I hope you found it interesting or helpful or both. In coming days and weeks, I will be posting on a variety of topics such as the economy, the markets, investments, the Fed, global trends, politics (of course) and whatever else I find interesting.

I hope you’ll subscribe and become a member of the family. If so, feel free to submit comments and/or suggestions.

Popular opinion never seemed like a good indicator of a plan’s value, but history should be. This “plan” looks like that same stimulus thinking that’s been unsuccessfully tried since the crash, and in fact was part of what got us up to the crash.

At what point do people stop banging their heads against the wall and look for a plan “B”? Maybe I’m completely nuts, but since the financial sector seems to be a wreck right now, shouldn’t we be cleaning up their books instead?