We’re not even halfway through the year yet, but 2023 has been a great year for the stock market. The S&P 500 Index is up almost 15% for the year. Some market pundits are predicting 2023 will be one of the best years ever for the stock market.

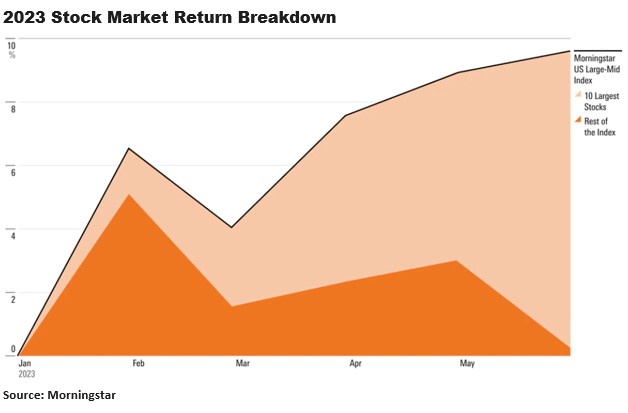

But what if I told you that nearly 80% of this year’s stock market gain was delivered by only five of the largest companies in America.

That’s right: the five largest stocks – Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL), Amazon (AMZN) and Nvidia (NVDA) – have accounted for 78% of the total gain so far this year. The rest of the market, for the most part, is lagging behind badly.

Those numbers are eye-popping compared with the market’s average long-term concentration. Since 2009, in years when stocks have risen, the five or 10 largest stocks generally contributed only about 5% to 10% or less of the market’s total gains.

This trend of hyper-concentrated returns isn’t entirely new, but this year it’s reached an unprecedented peak. The most recent previous high-water mark for a concentration of stock market returns came in 2020 when the five largest stocks at the time—Apple, Microsoft, Amazon, Meta Platforms (META) and Tesla (TSLA)—contributed 37% of the returns. In 2023 so far, the concentration of returns coming from the five largest stocks has been double that figure, a new record.

Without these five largest companies’ stellar performance, the stock market would be essentially flat for the year.

The five companies are part of the exclusive club of firms touching $1 trillion in market valuation, with Nvidia becoming the latest company to hit the milestone.

Collectively, the five companies have raised their market cap by about $2.9 trillion in 2023 — contributing 96% of the almost $3 trillion gains in the S&P 500’s market value this year.

Though no year in history has been as concentrated as 2023 has been so far, clusters of outperformance or underperformance in the markets are natural. When one of those clusters involves the largest stocks, this can have a significant impact on investor portfolios because the largest companies make up the largest weights of the market benchmarks that are most widely tracked by index funds.

For investors in index funds that track the overall market, the effect is the same. An S&P 500 fund or another broad-stock market fund will still have earned them roughly double-digit returns. But as investors learned at the tail end of 2021, big returns on a small group of stocks can also turn into big losses should that handful of companies run into trouble.

This year through May, Apple – the largest stock in the US market, with a market capitalization of $2.8 trillion – has been responsible for 17% of the market’s returns. The largest three stocks this year have together contributed nearly 50% of the stock market’s rise.

Finally, not all of the 10 largest stocks have contributed positively to the market this year. Private health insurance giant UnitedHealth Group (UNH), the 10th-largest stock with a market cap of $453 billion, has fallen 7.8%, acting as a 0.15% drag on the market.

Fed Chairman Powell Warns of More Interest Rate Hikes

Jerome Powell, the chairman of the Federal Reserve, told House lawmakers this week that the United States remains a “long way” away from low and stable inflation, even 15 months into the central bank’s campaign to cool the economy and wrestle down rapid price increases.

Mr. Powell testified before the House Financial Services Committee on Wednesday. He told lawmakers the labor market remained very tight and inflation – while it has come down notably from its peak last summer – was still too high.

In light of that, Powell warned the Fed is likely to raise interest rates even higher than their current level of just above 5% before the end of this year. Powell’s remarks yesterday disappointed many Fed-watchers who had been hoping the Fed’s decision to leave interest rates unchanged at its latest policy meeting on June 13-14 would lead to some interest rate cuts later this year. Not going to happen, according to Mr. Powell.

The Fed’s policy committee meets next on July 25-26 and September 19-20. I expect the committee to raise its benchmark Fed Funds rate by 0.25% at each of those meetings. That will put the Fed Funds target range at 5.50%-5.75%, up from 5.00%-5.25% currently.

Mr. Powell told lawmakers that even though inflation has come down over the last year, “inflation pressures continue to run high, and the process of getting inflation back down to 2 percent has a long way to go.”

You can’t get much clearer than this.

Sorry, comments are closed for this post.