Bowing to widespread public pressure, the Federal Reserve voted to leave interest rates unchanged at its latest policy meeting concluded yesterday. The decision to “pause” hiking rates after 10 consecutive increases came as a surprise to no one, but the Fed made it clear that at least a couple more rate hikes will likely be forthcoming later this year.

In the distant past, Fed decisions regarding interest rate policy were shrouded in secrecy, and the financial markets were left to wonder what the Fed’s next move might be. But those days are long gone, and the Fed routinely telegraphs its policy intentions well in advance. Thus, there are rarely surprises regarding what the Fed is going to do.

So, here is the plan going forward. While the Fed bowed to public pressure to take a pause at its latest policy meeting this week, Chairman Jerome Powell made it clear in his press conference yesterday that there will be more rate hikes before the end of this year.

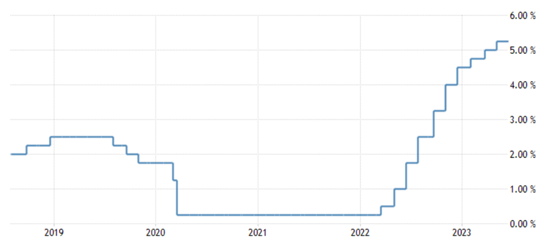

Most Fed-watchers now expect there will be two more quarter-point rate hikes later this year. If correct, this would push the Fed Funds rate from the current range of 5.0-5.25% to 5.50-5.75% before the end of this year.

Fed Funds Rate

Source: Federal Reserve Bank; chart courtesy of TradingEconomics.com

If this is indeed the path the Fed chooses to follow, it will be the largest increase in the Fed Funds rate since the late 1970s/1980 when inflation, as measured by the Consumer Price Index, soared to near 15%. I remember those days.

Chairman Powell made it clear in his press conference yesterday that the Fed remains committed to getting inflation down significantly from current levels. After peaking at a 40-year high of 9.1% last year, the Consumer Price Index rose at an annual rate of 4.0% in May. That is still well above the Fed’s inflation target.

The Fed’s favorite indicator of inflation is the Personal Consumption Expenditures Index (PCE), which rose at an annual rate of 4.4% in the latest report. The Fed wants to see the PCE fall to closer to its target range of 2%, which most analysts believe is not very likely.

In any event, this means the Fed will almost certainly continue to hike interest rates at least a couple more times this year. The financial markets fully expect at least one more interest rate hike, so nothing the Fed or Chairman Powell said this week came as a surprise.

Retail Sales Forecast To Rise 4%-6% In 2023

Consumer spending makes up over 70% of Gross Domestic Product, the sum of all goods and services produced in the US. Continued healthy consumer spending has been what has kept the US economy out of recession this year.

The question is whether consumer spending will continue to be strong for the balance of this year, or are there reasons to believe Americans will curb their appetites in the second half of this year? Time will tell, of course, but there are currently no signs that US consumers plan to pull in their horns anytime soon.

Case in point is the 2023 retail sales forecast from the National Retail Federation (NFR). Earlier this year, the NFR predicted that retail sales would rise 4% to 6% in 2023. If correct, this would put retail sales at $5.13-$5.23 trillion this year, up from $4.9 Trillion in 2022.

Online retail sales look even stronger. The NRF forecasts that online retail sales will rise a whopping 10% to 12% this year. Retail sales as reported by the NRF and others include retail stores, online sites and restaurants.

Interestingly, while online retail sales are growing rapidly, the NRF reports that most consumers continue to prefer shopping in-person at brick-and-mortar outlets such as malls and stores they can physically go into.

The NRF says that 70% of all retail sales still occur at brick-and-mortar stores where shoppers can physically go in, see the actual products, try things on if they wish and make returns if necessary.

I have to admit I fall into this latter crowd. While I don’t go shopping very often, I do prefer to go to stores where I can actually see the merchandise, try it on if I wish and have a real person there to answer my questions, if any.

I don’t much like shopping for personal items online. You never know if what you’re going to get will actually look or fit as it appears on the Internet. Call me old fashioned if you like.

Getting back to retail sales increasing this year, this morning the Commerce Department reported that retail sales in May rose 0.3%, which was higher than most analysts expected.

However, for the 12 months ended May, retail sales rose only 1.6%, which was below the pre-report consensus.

So, it remains to be seen if retail sales will rise by the 4-6% annual rate forecast by the NRF. In any event, if consumers continue to spend as they have so far this year, there will be no recession in 2023. Of course, I’ve been saying that all year.

Sorry, comments are closed for this post.