Candidate Joe Biden promised a lot of tax increases when he was running for the highest office in the land in 2019 and last year. Yet since he’s been president, he hasn’t followed through on those promises, at least not so far. This is largely because thanks to Democrat Senators like Joe Manchin (WV) and Kyrsten Sinema (AZ), he doesn’t have the votes to pass them.

Today I want to talk about one of President Biden’s most egregious, but least discussed, tax proposals — which is the repeal of the so-called “step-up in basis” upon inheritance of a decedent’s estate. In talking with friends and colleagues about this recently, especially among younger folks, I get the impression a lot of people don’t know just how really bad the repeal of the step-up in basis would be for the economy. So, let’s dig into it.

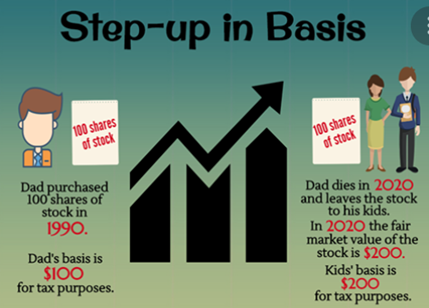

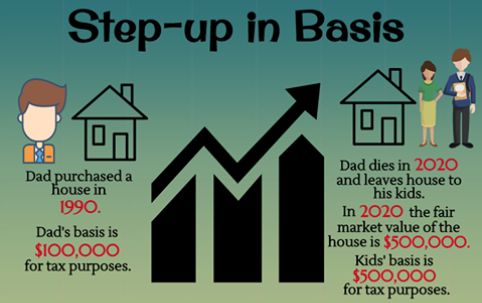

The step-up in basis essentially “resets” the cost basis of an asset upon inheritance for the purpose of capital gains taxes. The cost reset protects heirs from paying a hefty tax should they decide to sell inherited assets.

To explain, let’s use a simple example where a person purchases an asset for $100 in 1970. Upon that person’s death in 2020, the asset has grown to be worth $1,000. The step-up in basis allows the cost basis of the asset to be reset to its current value when the heir acquired it (in this example, $1,000). Should the heir decide to sell the asset before it appreciates further, they would not owe any capital gains tax.

If the longstanding step-up in basis is repealed, the heir would be responsible for paying taxes on that $900 capital gain should they choose to sell the asset. This is huge and would be a big drag on consumer spending and thus the economy. Yet this is what President Biden and his leftist cronies apparently want.

Admittedly, the step-up in basis is not a perfect tax policy, and some argue it can allow opportunities for tax avoidance. However, eliminating it would compound other flaws in the tax code. One such problem is the existence of the so-called “death tax,” which often causes heirs to have to sell off certain inherited assets just to pay the tax bill they receive for inheriting deceased family members’ assets.

Without the step-up in basis, the burden of the death tax would only get worse and would increase asset sales even further to pay the estate tax. The death tax is unfair enough as it is, so let’s don’t make it worse by repealing the step-up basis.

Another problem with repealing the step-up basis is the fact that many decedents don’t leave adequate paperwork to determine the original cost basis for assets acquired decades before. The step-up in basis, by resetting it each time an asset is inherited, eliminates that necessity.

A final problem with the elimination of the step-up basis has to do with inflation. Much of the supposed gains subject to capital gains taxes, particularly those passed down from one generation to the next, are driven by inflation, rather than appreciation of the underlying asset. Take the above example — though the heir has a capital gain of $900, some $600 of it may be due solely to inflation. The step-up in basis is a tool which can shield heirs from paying taxes on inflation.

The bottom line is the elimination of the step-up basis would create major hassles for taxpayers. And according to the nonprofit Tax Foundation, repealing the step-up basis would only generate $11-$12 billion in additional annual tax revenue for the government. In the big picture, it’s just not worth the headaches.

Finally, I’ll tell you the main reason I believe the step-up basis will not be eliminated: Other than some ultra-liberals in Washington, no one in Congress wants to get rid of the step-up basis. Think about it – almost everyone in Congress is rich, many are super rich. They’ll all be passing down very valuable assets to their heirs. In truth, they like the step-up basis tax policy.

So while Joe Biden promised to eliminate it on the campaign trail, I haven’t heard him mention it since. He does, however, continue to say he won’t raise income taxes on anyone making less than $400,000 a year, but repealing the step-up in basis would be a tax increase on ALL taxpayers.

It will be interesting to see if he even mentions it in his re-election campaign.

As usual, you are free to share this information with anyone you feel could benefit from it.

Sorry, comments are closed for this post.