As regular readers know, I have been surprised at how negative most forecasters have been on the US economy this year. Since the beginning of the year, most forecasters were convinced we would have a recession in the second half of this year, and many predicted it would be a serious contraction.

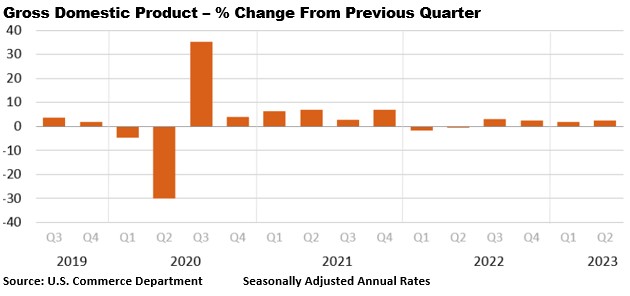

Well, here we are at the end of July and there is still no recession in sight. The Commerce Department reported this morning that Gross Domestic Product rose by 2.4% (annual rate) in the second quarter following growth of 2.0% in the 1Q. This was better than the pre-report expectation of just under 2.0% on average.

Many forecasters are having to rethink their predictions for a recession this year. While forecasters have a tendency to stick by their predictions, even when those positions look to be in error, many are having to revise their earlier predictions – as I have suggested all year.

For example, a recent survey of business economists by Bloomberg found that less than half now believe we will have a recession later this year. This is down considerably from where we were at the beginning of this year.

The case for a recession in 2023 was largely based on these factors: (1) the Fed was raising short-term interest rates by the most in 40 years; and (2) consumer prices and wage inflation were rising sharply. Given the likelihood that the Fed would have to raise interest rates considerably higher, many forecasters just assumed a recession would follow.

Regular readers will recall that I was never in the bearish camp regarding the economy this year. I repeatedly questioned whether we would have a recession this year. I was not convinced the Fed would have to raise rates significantly higher to get inflation under control, and as discussed below, only one more quarter-point rate hike is expected in this cycle.

That has not been enough to throw the economy into recession, and more and more forecasters are coming to recognize this. As a result, many are dialing back their forecasts for a recession later this year. Of course, this is not the first time such a reversal has happened.

Fed Raises Interest Rate – Signals One More Hike Likely

The Fed Open Market Committee (FOMC) met on Tuesday and Wednesday of this week to set monetary policy and short-term interest rates for the next couple of months. There were no surprises at the meeting.

The Fed Open Market Committee (FOMC) met on Tuesday and Wednesday of this week to set monetary policy and short-term interest rates for the next couple of months. There were no surprises at the meeting.

The FOMC raised its benchmark Fed Funds rate from 5.00-5.25% to 5.25-5.50% as was widely expected. The Fed’s policy statement hinted that another rate hike could be necessary before the end of the year, but emphasized that such a decision would be entirely data dependent.

Fed Chairman Jerome Powell made it clear in his post-meeting press conference that while inflation has come down considerably since peaking last year, with the Consumer Price Index currently at 3% year-over-year, it is still above the Fed’s target of 2%.

He emphasized the Fed will likely continue its rate hikes and policy tightening measures if inflation does not continue to fall. Again, none of this came as a surprise to anyone who follows the Fed’s policy actions even remotely.

There continues to be a contingent of Fed-watchers that believes this week’s rate hike to 5.25-5.50% will be the last of the Fed’s rate increases this year. While that is not out of the question, I do not believe it is the most likely scenario.

The most likely scenario, in my opinion, is that the Fed raises its short-term interest rate once more before the end of this year. But as Mr. Powel made clear in his press conference, another rate hike will only happen if inflation does not continue to fall toward the Fed’s target.

There is also a contingent of Fed-watchers that believes the central bank will begin cutting interest rates before the end of this year. I do not believe that will happen either. The only way the Fed would begin cutting rates this year, in my opinion, is if the economy fell into a serious recession.

As noted above, while a lot of forecasters still predict a recession before the end of this year, those predictions are becoming more questionable as more economists are now expecting the economy to continue to grow in the second half of this year.

To sum up, the Fed raised its key interest rate to 5.25-5.50% this week as expected. The Fed will likely raise this rate one more time this year to 5.50-5.75% to end this cycle of tighter monetary policy. The Fed is not likely to begin cutting interest rates until sometime next year, if at all.

Thus far, the Fed’s interest rate hikes haven’t had a significant negative impact on the economy. But they have been successful in bringing down inflation significantly from the peak last year. In that regard, we’d have to concede the Fed has been successful.

Sorry, comments are closed for this post.