Many economists continue to forecast a recession in the second half of this year, due primarily to the Fed’s tightening of monetary policy and higher interest rates. But that recession has not arrived yet, as government fiscal policy is still stimulative; real interest rates are not yet restrictive (the nominal yield on Treasury bills remains below nominal GDP growth).

The household sector still has significant savings built up during the pandemic, when interest rates were much lower. Meanwhile, corporations extended the maturity of their loans, making them less vulnerable to higher rates; and the dominant service sector, which is less sensitive to interest rates, continues to grow.

Despite the Federal Reserve raising interest rates to a 16-year high of 5.0%-5.25%, since its first hike in the Fed funds rate in March 2022, the economy has defied forecasts of a recession, as employment continues to show strong growth. Consumer spending has declined this year, but so far not to the point of sparking a recession – although this trend must be watched closely.

Here we are in the second half of the year, and there remain few signs of a recession on the horizon. While spending on goods has slowed (as has goods price inflation), spending on services, which are less sensitive to interest rates and constitute about 78% of GDP, continues to be strong even as economic growth has slowed. As a result, the rate of increase in prices on services remains well above the Fed’s target.

This suggests the Fed is not done raising interest rates as I have maintained all year.

One sector in the US economy is raising particular concerns among those forecasters who predict a recession later this year. That sector is US manufacturing which is clearly in a recession. Let’s take a closer look.

Manufacturing

The US ISM Purchasing Managers Index (PMI) is a diffusion index summarizing economic activity in the manufacturing sector in the US The index is based on a survey of manufacturing supply executives conducted by the Institute of Supply Management (ISM). Participants are asked to gauge activity in a number of categories like new orders, inventories and production, and these subindices are then combined to create the PMI.

A PMI above 50 indicates an overall expansion of the manufacturing economy, whereas a PMI below 50 signifies it is shrinking. As seen in the table below, the manufacturing sector has been contracting for the last several months.

While the numbers above indicate the US manufacturing sector has been in a mild recession, keep in mind that manufacturing represents only about 11% of the overall economy.

The overall economy, as measured by GDP, is still positive on the year. GDP was up 2.0% in the 1Q, and a survey of economists by Bloomberg earlier this month showed most forecasters believe the economy is growing by just over 1% in the 2Q. Again, no recession in sight.

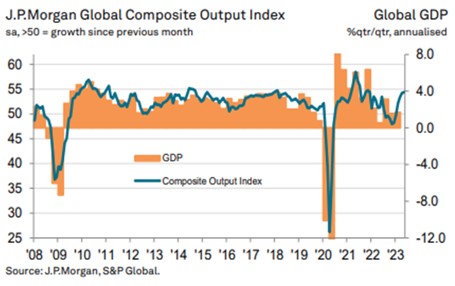

We see the same trends globally. The May 2023 J.P. Morgan Global PMI Composite Output Index, produced by S&P Global, showed that while manufacturing output rose for a fourth straight month in May, the overall rate of growth remained modest.

It also showed that new order inflows for goods shrank for an 11th straight month; new export orders for goods fell worldwide at the fastest pace since end of 2022; and the PMI future expectations indices showed that manufacturers’ confidence had sunk to a five-month low and was below the survey’s long-run average.

While the above statistics are discouraging for sure, they do not indicate a recession is underway or just around the corner.

As a result of weak demand, average prices charged for goods leaving the factory gate fell for the first time in three years. That’s good news in the fight against inflation but bad news for corporate profits. While this trend bears watching, it doesn’t by itself indicate a recession is looming.

Rising Office Space Vacancies A Major Concern

As I discussed at length in my June 27 Forecasts & Trends, I believe the significant rise in office space vacancies is the biggest threat to the economy at present. What I didn’t mention in my June 27 newsletter is the fact that the increase in commercial real estate office vacancies due to working and shopping from home will hit municipal tax revenues hard, as they rely heavily on property taxes.

A secondary impact of the shift to working/shopping from home is that revenues at retail stores and restaurants located near offices are falling, as will property values, sales tax revenues and related income tax revenues. This also bears careful watching.

As I have said many times in recent months, a recession could certainly unfold later this year, especially if consumer spending continues to fall. I just don’t see it as the most likely scenario.

Sorry, comments are closed for this post.