The Fed Open Market Committee which sets monetary policy meets next Tuesday and Wednesday (March 21-22) and is widely expected to raise its Fed Funds Rate target by a quarter point from 4.50%-4.75% to 4.75%-5.00%.

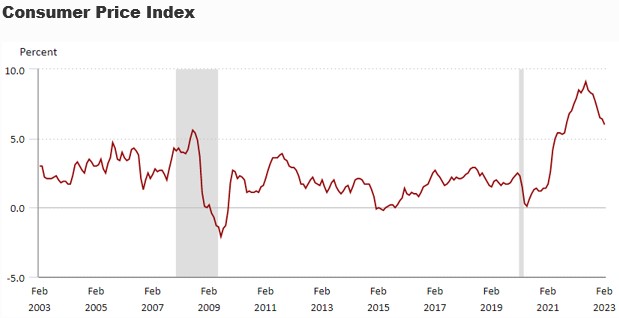

The Fed has been raising its benchmark interest rate for over a year in an effort to slow US inflation. US inflation since 2010 had held pretty steady with the Consumer Price Index (CPI) running in mostly a 2%-3% range. However, the CPI turned sharply higher in 2020 and soared just above 9%, as you can see below.

The Fed, of course, is determined to get inflation under control and set about raising short-term interest rates in an effort to slow the economy last year to hopefully reign in prices. It is expected the Fed will raise its short-term interest rate several more times this year.

As you can see in the chart, inflation has come down significantly from the peak last year. The CPI slowed to an annual rate of 6% in January, the slowest rate since September 2021. The question is: Is the inflation rate falling fast enough for the Fed?

The Fed wants to see the inflation rate back down to its target of around 2%, so it still has a long way to go. Many Fed-watchers, myself included, do not believe the Fed will be able to get inflation back to 2% in the foreseeable future, but that doesn’t mean they won’t try.

The concern is the Fed will likely have to raise interest rates substantially to get inflation anywhere near its 2% target. The fear is this will spark a recession later this year and/or next year. Nobody wants to see that. But most Americans would like to see the Fed get prices under control.

It’s a balancing act, of course, and it remains to be seen if the Fed can pull it off.

I think it’s reasonable to assume the Fed can get inflation back down to 4% this year, maybe even a little lower. But getting it all the way back down to 2% this year or next is very unlikely in my opinion.

Which brings us back to the question: Is inflation falling fast enough for the Fed? We may have our answer next Wednesday when the Fed is widely expected to raise the Fed Funds rate. The question is whether the Fed raises its rate by one-quarter point (0.25%) or by half a point (0.50%).

If the rate rises by only a quarter-point, that would suggest the Fed is content with how fast inflation is coming down. If they raise it a half-point, that will suggest the Fed wants to see inflation coming down faster.

It would also suggest the Fed will raise interest rates several more times this year, which is what I have suggested is the most likely scenario. I still believe that.

But we do have a new wrinkle to think about. We’ve seen two largely unexpected bank failures this month. Silicon Valley Bank and New York based Signature Bank both failed earlier this month. While not two of the largest banks in the US, their failures no doubt got the Fed’s attention.

Some believe these two bank failures will cause the Fed to put a pause on its interest raising campaign. I would be very surprised if it did. The government quickly made all the banks’ customers whole, so no depositors lost any money, and the failures did not spark a financial crisis.

So, I fully expect we’ll see the Fed raise rates at least a quarter-point next Wednesday and again at its next policy meetings on May 2-3 and June 13-14.

Beyond that, we’ll have to see what happens. Will inflation continue to fall in the second half of this year? I think there’s a very good chance it will.

Yet the question remains as to whether inflation is falling as fast as the Fed wants to see. No one knows for sure. All we can do is monitor the Fed’s interest rate policy over the next several months to see how aggressively they hike the Fed Funds rate.

Let’s hope the Fed hits the right balance with rate hikes large enough to get inflation under control but not so high as to cause a recession later this year.

Call me optimistic but I think they might just pull it off.

The economy is fundamentally solid with the lowest unemployment rate in 50 years. And everyone knows the Fed rate hikes are coming.

Now the question is whether the Fed will overdo it. That’s the last thing the Fed wants to do.

Sorry, comments are closed for this post.