Each year New York University (NYU) updates the average annual returns for stocks (S&P 500), bonds (10-year Treasuries) and cash (3-month T-bills) going back to 1928. I like looking at data like this because stocks, bonds and cash are the building blocks of asset allocation.

Sure, you can add other asset classes and strategies, which I recommend, but those three are where most investors should start when it comes to figuring out their portfolio mix.

We’ll start with the average returns for these three asset classes in 2022. Obviously, 2022 was a tough year:

- Stocks: -18.0%

- Bonds: -17.8%

- Cash: +2.0%

Bonds were down particularly badly last year as the Fed raised interest rates seven times. If you owned a total bond market index fund, 2022 was your worst year of performance ever.

Bonds being down double-digits was painful but makes sense in the context of interest rates rising from their lowest levels in history and inflation spiking to above 9%.

The more surprising performance number here is the fact that TIPS (Treasury Inflation-Protected Securities) were down double-digits as well and barely outperformed the aggregate bond index.

There are reasons TIPS were down in a year with rapidly rising inflation – namely, TIPS act like bonds when interest rates rise quickly. Nonetheless, most TIPS investors were very surprised last year.

Cash beat stocks and bonds last year for the first time since 2018 and had its highest return since 2007.

Stocks and bonds historically have higher long-term returns than cash but it’s not out of the ordinary for cash to be the best asset class in a one-year time frame.

NYU says, it’s happened 14 times over the past 95 years. So relatively rare but not out of the question. Before 2018, the last time it happened was in 1994.

Bonds have beaten stocks 35 times in a calendar year since 1928. Cash has beaten stocks 31 times out of the past 95 years.

So, while stocks are your best bet over the long run, over the short run anything can happen.

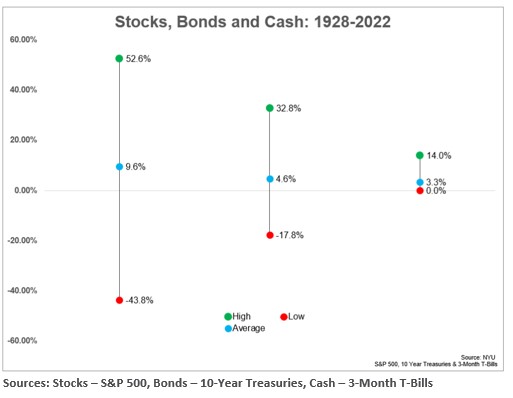

These are the average annual returns for each from 1928-2022 (95 years):

- Stocks: +9.6%

- Bonds: +4.6%

- Cash: +3.3%

Long-term investing is great and all, but returns over the short-term should be considered anything but average. You just never know when we’ll hit a bad year.

Looking at the range of results around the averages does a nice job of explaining why the long-term returns line up like they do:

Stocks go up for lots of reasons but one of the biggest ones is the fact that sometimes they go down a lot.

The S&P 500 has been down in 26 of the last 95 years. Bonds were down 19 times over the same period. Stocks declined double-digits 12 times while 10-year Treasuries have had just 2 calendar years with returns of -10% or worse in that same period.

Cash has never had a down year on a nominal basis.

This is the trade-off we’re forced to make as investors.

Cash gives you short-term peace of mind and not much variability but low expected returns. Stocks provide protection against inflation over the long-term but kick you in the teeth on occasion in the short-term.

Bonds are somewhere in the middle.

Inflation is all the rage these days, what with the Consumer Price Index soaring to a 40-year high last year, so it’s also helpful to look at the long-term returns net of the inflation rate.

Inflation has averaged a little more than 3% from 1928 through 2022 which leads to the following real, inflation-adjusted annual returns in that time:

- Stocks: +6.5%

- Bonds: +1.5%

- Cash: +0.2%

The point of this exercise is not to prove the superiority of any one asset class over another. They all have their own pros and cons.

The point is that it’s helpful to know going into each asset class what you can reasonably expect in terms of outcomes over various time horizons.

No one knows what the exact returns will be like over the next 95 days or 95 years for stocks, bonds or cash. There are a lot of variables we simply cannot predict.

But it’s a safe bet to assume stocks will beat bonds and bonds will beat cash over multi-decade periods.

It’s also safe to assume cash or bonds can beat stocks in shorter time periods.

This is what makes investing relatively simple but never easy.

Clear, concise yet comprehensive summation and discussion of the historical returns for the three primary asset types that should be the foundation for most investors portfolios. Very nice job, Gary.