2022 was an expensive year for consumers with the cost of living rising faster than incomes, forcing many Americans to take on more debt to make ends meet. And interest rates which have increased in response to inflation are making debt more costly.

NerdWallet, an American personal finance company, surveys consumers each year and looks at, among other things, household debt. It also uses data from the US Labor Department and the Federal Reserve Bank among other sources.

In its latest report for 2022, NerdWallet found that household debt increased significantly last year. For example, credit card balances carried from month to month have increased over the past 12 months, totaling an estimated $460 billion last year. Mortgages, auto loans and overall debt loads also increased over the past year.

For 2022, NerdWallet found that the average American household has outstanding debt of $165,388, up 7.65% from 2021 – and a new record high. This comes as somewhat of a surprise considering that unemployment fell last year and the overall economy grew about 1% in the first three quarters of the year.

Yet while the level of household debt rose to a record high last year, the trend is not new. While the median household income has grown 7% percent since the start of 2020, overall costs of living have gone up 16% over the same period.

Here’s the breakdown of what US households owed in total and the average amount per household with each type of debt, as of September 2022.

Making matters worse for consumers is the fact that interest rates paid on debt increased significantly last year, thanks to the Federal Reserve raising its key Fed Funds rate several times in 2022.

As you can see above, the average US household has nearly $7,500 in “revolving” credit on which they make monthly payments. As you can also see, the annual increase in revolving credit was 28.73% in 2022, by far the largest increase of any debt category.

Interest rates on credit card debt are now around 19%, the highest ever. Most households are expected to pay $1,380 in credit card interest alone in 2023. Unfortunately, many people don’t realize how much interest they pay on the outstanding debt they have.

Even worse, more than a fifth of Americans (21%) aren’t sure whether future interest rate increases will have an impact on their finances, according to the NerdWallet survey.

Here are a couple of other findings from the latest NerdWallet report:

Prices are rising faster than incomes. In the past year, median household income has grown just 4%, while the overall cost of living has jumped 8%. The survey found that nearly half of employed Americans (45%) say their pay hasn’t increased enough over the past 12 months to keep up with inflation.

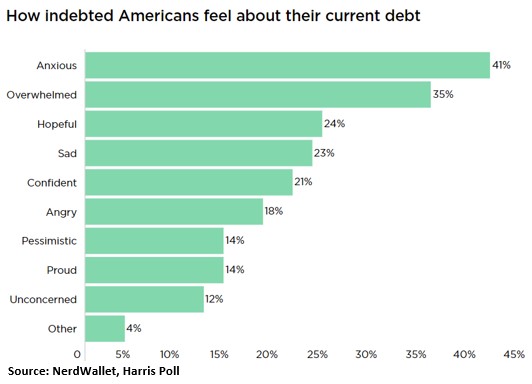

Consumers are anxious about their finances over the next year. Nearly 7 in 10 Americans (69%) have financial concerns about the next 12 months. The #1 worry is having to go into debt/more debt to cover necessities (31%), followed by having to pay higher interest on their debt (27%).

“Credit card debt is often thought to be the result of frivolous spending, but for many Americans, that’s just not true,” says Sara Rathner, a NerdWallet credit cards expert. She says consumers are feeling the squeeze of higher prices and interest rates, and paychecks just aren’t keeping up.

That’s forcing many to make tough decisions, like going into debt to pay for necessities. One recent survey found that nearly half (49%) of Americans rely on credit cards for essential living expenses.

Savings Rate Takes A Hit

The personal savings rate measures how much of Americans’ after-tax, or disposable, income is left over after spending on bills, food, debt and everything else. Calculated and reported by the US Bureau of Economic Analysis (BEA), it is an important component of the financial security of American families.

Not surprisingly, according to the BEA analysis, the personal savings rate for Americans fell to 2.3% last year, the lowest rate in nearly two decades. This means the average household saved just $2.30 for every $100 they earned after paying taxes. For context: That rate is about four times lower than average over the last fifty years.

In conclusion, the record rise in household debt and the significant decline in the savings rate are not good developments for the economy. Remember, consumer spending makes up over two-thirds of GDP.

Does this mean we are headed for a recession this year? It’s impossible to know for sure. But what we do know is these trends, at the least, mean economic growth will be anemic this year and possibly beyond.

Making matters worse, the Fed is widely expected to raise interest rates several more times this year in its effort to get inflation under control. This also does not bode well for the economy. It doesn’t sound good for the financial markets either. It’s shaping up to be a challenging year, especially for investors who only have “buy-and-hold” strategies in their portfolios.

There are plenty of alternatives out there. Now may be a great time to consider them.

Sorry, comments are closed for this post.