This is a terrible time to buy a car! Not only are dealers’ lots the lowest ever in inventory, prices for new and used cars are through the roof.

The entire auto industry has been hobbled for months by the worldwide shortage of semiconductor chips, which has prevented manufacturers from producing enough vehicles to meet the demand from Americans eager to spend their pandemic savings and stimulus checks. As a result, many dealerships are practically barren of inventory, and new and used cars are fetching record prices.

The cost of used vehicles, in particular, has skyrocketed into the stratosphere. Last week, the Department of Labor reported the retail price of pre-owned cars and trucks jumped a record-breaking 10.5% in June, after rising 7.3% in May and 10% in April. It doesn’t matter if your heart is set on a tricked-out new Suburban or you just want a used Honda Civic to take you from point A to point B – the market is brutal for everybody.

Some lightly used cars are actually selling for more than they did when new – assuming you can find what you want. So much for negotiating down from the sticker price as we’ve always done! Not surprisingly, vehicle sales volume has fallen sharply since April.

So, how long will we be stuck with these shortages? Is the car biz’s COVID hangover destined to linger on? Or will the industry, like the rest of our once-dreary-eyed economy, soon return to normal? Most articles I read for this piece said it will be well into 2022 before dealer inventories are anywhere near back to normal. Some predict it will be the end of next year.

The automotive sector’s current troubles date back to the start of the coronavirus crisis, when car manufacturers shut down their factories and canceled orders from their suppliers, including chipmakers, in the face of nationwide lockdowns.

Instead of waiting around for Ford, GM and the rest to restart production, semiconductor firms simply went out and found new customers, selling more product to smartphone manufacturers and other electronics makers whose business was suddenly booming.

Once the auto companies turned their assembly lines back on, they discovered that there were no longer enough chips to go around. The shortage effectively kneecapped their ability to produce cars, since modern vehicles are heavily computerized, with each containing hundreds (or more) of chips.

The industry’s chip shortage forced automakers to keep plants idle and cut back production throughout 2021, while scrounging for chips wherever they could find them. Some decided to cut features like wireless phone charging to economize their semiconductor rations. The situation has been further exacerbated by a fire at a Japanese chip maker and the brutal winter freeze in Texas, which put further strain on the world’s semiconductor supply.

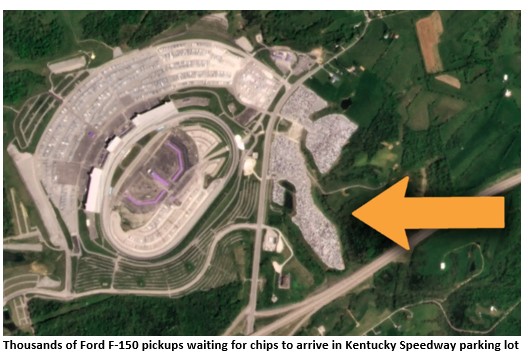

Some companies have been hit harder than others. Ford, for example, said it would likely have to miss half its second-quarter production this year, and its sales in June fell by 26%. The giant at one point resorted to cranking out thousands of its money-making F-150s without their essential chips, and stocking them away for later in a giant parking lot in Kentucky which can be seen from space.

The automakers have enjoyed at least one silver lining in all this: Their profits have boomed! With so few cars and trucks for sale and customers aplenty, dealers haven’t had to mark down the prices on vehicles in order to get rid of extras on the lot. But car sales dipped in both May and June thanks to historically low inventory and soaring prices. Auto industry analysts are worried the “supply crisis” could start to weigh on the industry if it isn’t solved soon.

It’s not entirely clear at this point whether the worst of the chip shortage is fully behind the industry, or how long the problem will take to fully solve. Just recently, Audi’s CEO said the issue could dog the company until the end 2022. Other automakers say the same thing.

As for used cars in particular, no one seems to think their prices will come back to earth until the new car market is back in shape. But there are signs they might at least be about to plateau, and could even give up some gains. Though retail prices for used cars increased in June, the wholesale prices dealers pay for vehicles at auction fell slightly, as shown in the chart above.

If so, that might help soothe the nerves of economic policymakers, especially at the Federal Reserve. Recently, used car and truck prices have been the single biggest component driving the latest burst of inflation America has experienced; in June, used car prices constituted more than one-third of the entire increase in the Consumer Price Index. If the cost of used vehicles simply levels off, it would help cool off the next few months of inflation data.

Even so, consumers will face sticker shock at the car lot for the foreseeable future.

Sorry, comments are closed for this post.