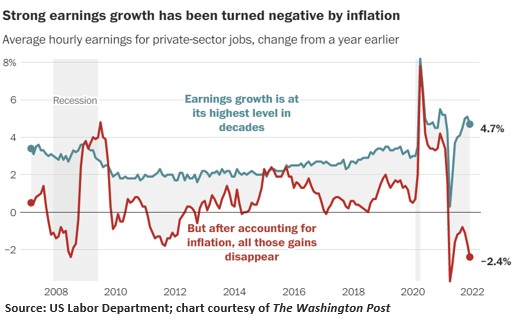

After years of barely budging, wage growth is finally at its highest level in decades. The global pandemic, combined with swift government stimulus and unexpected labor shortages, have put workers in the driver’s seat, giving them the kind of negotiating power they had never imagined.

But in an unexpected twist, the same strong economic recovery that is emboldening workers is also driving up inflation, leaving most Americans with less spending power than they had a year ago. Although average hourly wages rose 4.7% last year, when adjusted for inflation overall wages fell 2.4% on average for all workers, according to the Labor Department.

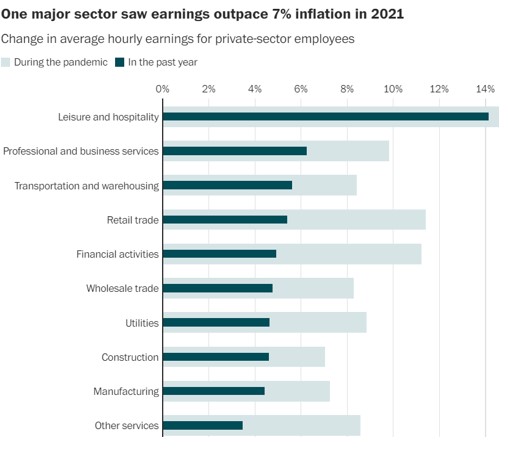

The only sector where pay increases outpaced inflation last year was in the leisure and hospitality industry, where workers generally make the lowest hourly wages of any sector. Workers there saw a 14% average raise from about $17 an hour to more than $19.50, according to an analysis of Labor Department data.

In interviews with dozens of workers, many said that despite considerable pay raises – as much as 33%, in some cases – they were still struggling to cover basic expenses. Several workers said they had taken second jobs to keep up with rising costs for groceries, gas, rent, etc. And many said their budgets would be even more strained once student loan payments resumed.

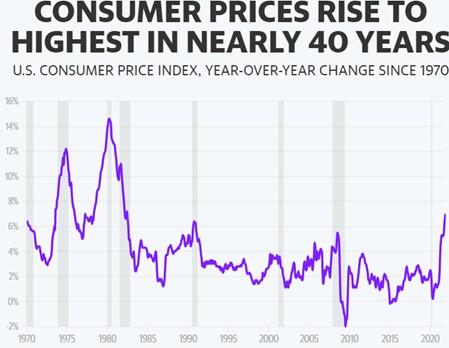

Inflation rose 7% last year to its highest level in four decades, as supply chain disruptions and labor shortages collided with growing demand from US consumers. Gas prices are up 50% from a year ago, while the price of meat, fish and eggs is up nearly 13%, according to the US Consumer Price Index. Used car prices soared almost 30% last year.

But inflation and wage growth can become intertwined. Most economists consider this round of wage growth a natural result of the strong economic recovery, as well as competition for workers. But some worry the cycle of high inflation and demand for higher wages can become self-reinforcing, as they were during the late 1970s and early 1980s.

If consumers and businesses start expecting inflation to continue for a long time, each side will keep trying to outbid the other – businesses by charging higher prices and workers by asking for higher pay – fueling yet more inflation.

Federal Reserve Chair Jerome Powell said recently he is not yet seeing evidence of such a “wage-price spiral” but the Fed is watching these trends closely as it prepares to combat inflation with interest rate rises this year.

More critically, the big question is whether overall wage growth amounted to a one-time increase or the start of a period of more sustained wage growth – particularly for the economy’s lowest-paid workers.

While the lowest-earning workers have seen the fastest wage growth in recent years – partly the result of cities, states and major employers raising their minimum wages – economists say that dynamic could change this year.

Wages are beginning to tick up in white-collar industries that rely heavily on foreign workers and are struggling to recruit enough employees given the slowdown in immigration during the pandemic, according to payroll software provider ADP.

A recent report by the Conference Board found that US businesses plan to raise wages by an average 3.9% this year, with higher pay for new hires and inflation being cited as the main reasons behind those hikes.

The big question is whether inflation will continue to run at 7% or higher this year, or will it subside. When inflation first jumped above 5% last year, Fed Chairman Jerome Powell assured Americans it was only “transitory” and would subside before long. Since then, the CPI has soared to 7% and shows no clear signs of retreating anytime soon.

In late November, Chairman Powell admitted the Fed’s use of the word transitory to describe the unexpected rise in US inflation was ill-advised and suggested the word be “retired” from the inflation discussion. Put differently, the Fed now thinks inflation could be with us a while.

The bottom line is, while most workers are enjoying nice pay increases for the first time in years thanks to the strong economic recovery, rising inflation has left most Americans with less spending power than they had a year ago.

In its latest survey of 500 economists, Reuters found more forecasters (40%) cited inflation as one of their biggest concerns for 2022. As a result, most central bankers around the world plan to increase short-term interest rates this year in an effort to keep inflation from rising further.

The US Fed is expected to bump up its Fed Funds rate by 0.25% at its next policy meeting on March 15-16. I’ll have more to say about this just ahead.

Sorry, comments are closed for this post.