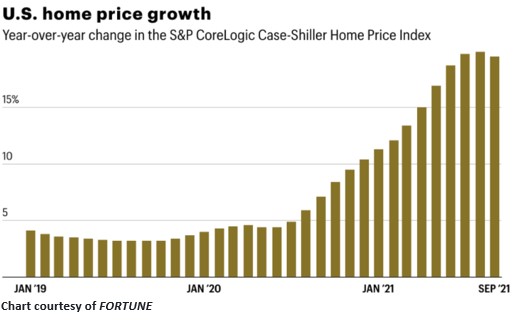

Home prices have exploded in recent years, and the last year saw a new record increase. Between August 2020 and August 2021, US home prices notched a 19.8% gain – the largest annual uptick on record. September to September saw another 19.5% spurt.

Some popular cities saw considerably stronger growth. Phoenix, San Diego and Tampa reported the highest year-over-year gains with price increases of 33.0%, 26.2%, and 25.9%, respectively. Imagine seeing your house appreciate a third in one year! It’s happening in Phoenix according to the latest reading of the S&P CoreLogic Case-Shiller Index, the leading measure of residential real estate prices.

The median US home price just passed $400,000 for the first time ever, according to the St. Louis Federal Reserve. In the third quarter the median home price hit $404,700, jumping nearly 13% since a year earlier. Goldman Sachs, Morgan Stanley and others predict home prices will rise another 15% or more over the next 12 months.

The US housing market defies all logic. Bull markets don’t last forever. Bear markets have not been eliminated. Yet home prices continue to be driven ever higher due to numerous factors including low inventories, building slowdowns due to the pandemic and older Americans opting to stay in their homes longer rather than moving to nursing homes – just to name a few.

As noted above, most real estate forecasting groups believe home prices will continue to trend higher for at least the next several years due to strong demand and limited inventory. But not everyone thinks price growth will continue at these unprecedented rates. Why not? The most common reason cited is the likelihood that interest rates will rise going forward, thus increasing mortgage rates.

30-year fixed rate mortgages have increased recently with rates having risen just above 3% this year. Most forecasters believe long-term interest rates will continue to trend gradually higher going forward, but what I’ve concluded over the last year is – nobody really knows. All we do know is rates are still near historic lows.

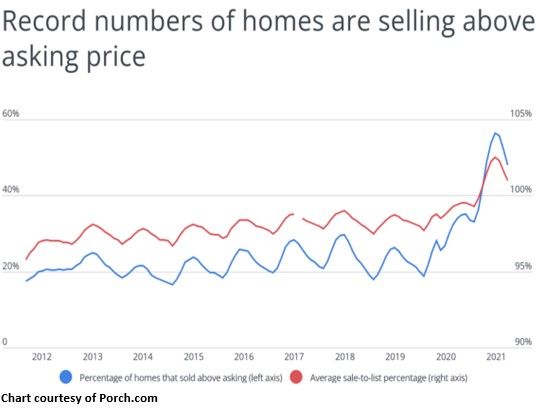

One of the most unusual aspects of the current housing boom, for me anyway, is the fact that so many houses across the country are selling at a premium to their listing price – in some markets a hefty premium. This is unusual historically.

Throughout 2020 and 2021, the market has seen steep increases in home prices as a growing number of buyers compete for a limited inventory of homes. These conditions have required bidders to be aggressive in their offers to beat out competitors, often offering opening bids significantly above the sellers’ asking price.

And the conditions contributing to this competitive environment show little sign of slowing down. One of the major issues is a constraint on supply. Many sellers elected not to list their homes during early months of the pandemic, which sent inventory to record lows late in 2020.

Even after the supply of existing homes returned to pre-pandemic levels, new construction has struggled to keep up with demand due to builders’ difficulties securing materials and labor. And these recent conditions do not even reflect the fact that the US already had a severe shortage of homes prior to the pandemic, according to statistics from Freddie Mac.

Seasonality in the market has finally slowed the upward trajectory of prices somewhat, but the share of homes selling above asking price is still well above historic levels. In most years before the pandemic, the percentage of homes selling above asking hovered around 20% during off-peak times and around 25% during the busy summer season.

Yet in 2020 and 2021, however, the share has remained much higher than usual, peaking at 56.4% in June 2021 – the highest ever. We see this all over Austin and Central Texas, and it’s happening in popular cities all across the country. Buyers know going in they are going to have to pay a premium to asking if they have any shot at getting a nice house, and some of the initial bids we hear about are outrageous!

The hot real estate market is a nationwide phenomenon, but some locations are especially competitive and more likely to see sales prices exceed the asking price. Coastal states report the highest percentage of homes selling above asking price. Five states – Massachusetts, Colorado, California, New Hampshire and Washington – have more than 60% of homes selling above asking price in 2021.

Finally, the trend of homes selling above list price is not happening just in large metro areas. It is also happening in small and mid-sized cities from coast to coast. There are exceptions, of course, but generally if the economy is strong and good jobs are available, homes are selling at a premium.

While supply and demand still rule the markets over the long haul, and bull markets eventually come to an end, this one looks like it still has some room to run. There are still a lot of young people living with Mom and Dad who will be looking to buy their first home in the years just ahead. Enjoy it while it lasts!

The best advice I received several years ago was to quit renting and buy a home, to lock in my housing costs. That has worked well, and I still believe it applies to anyone who can afford to buy a home.

I live in Georgetown. In August of 2017 I built a three-bedroom, 2100-square-foot house for $271,000. I just talked to a realtor last week and she said I could easily get $450,000 for it in today’s market. That’s amazing.

I do believe that the price increases will slow, and eventually stabilize, but when that happens is a guess (even though it might be an educated guess) on anyone’s part.

In the meantime, I’m one of those retirees who plans to live in my new house for as many years as I have left. If I ever do have to move into a “home” my equity, please my retirement accounts, should take care of it. That’s good news. The bad part of all this is that for many prospective homebuyers, home are getting too expensive, especially if mortgage rates to up.

Also, I’m about to close on a refinance (VA IRRL), which will lower my monthly payment (less taxes and insurance) to $884.

Our tiny little county of Branch in Michigan has seen housing prices double and triple in value. Selling as fast at they are put up for sale with no questioning of the asking prices. It’s been phenomenal!