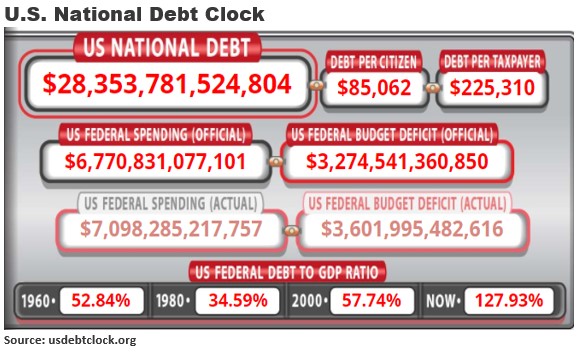

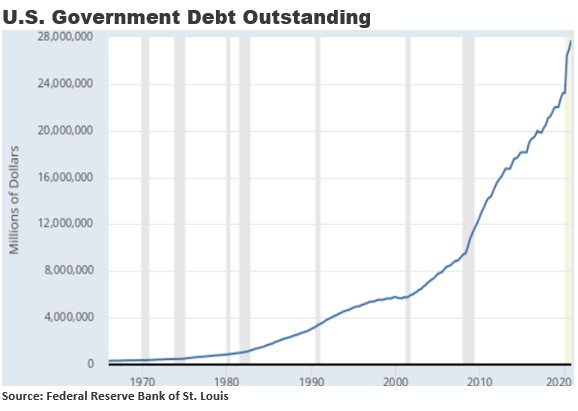

This is the question I’ve been asking for 40 years. I became preoccupied with the national debt in the 1980s when Ronald Reagan was president. I was a big Reagan supporter until he began running annual budget deficits, which swelled the national debt above $2 trillion by the time he left office. Now our national debt is more than 14 times that large as you can see below.

In Forecasts & Trends on Tuesday, I wrote about President Biden’s first federal budget proposal announced last Friday in which he asked Congress for just over $6 trillion in spending for fiscal year 2022, which begins on October 1. And the federal budget gets larger every year thereafter.

The president’s 10-year budget proposal shows federal budget deficits averaging $1.3 trillion a year or more for the next decade. That’s $13 trillion or more added to our debt over the next decade, ballooning it to $41 trillion or more. That’s an increase of 46% in just 10 years!

Would that finally be enough debt to tank the bond market and throw us into a financial crisis?

Or think about it another way: Our national debt will have exploded from just under $5 trillion in 2000 to over $41 trillion in less than 30 years. This has never happened before in dollar terms or in percentage terms. No one knows if the bond market can handle it, or if it will finally crash.

Now you might be thinking: Hold on there, Gary. Barack Obama more than doubled the national debt during his eight years as president, and the bond market didn’t tank. Plus, the economy recovered somewhat under Obama. And that would be true.

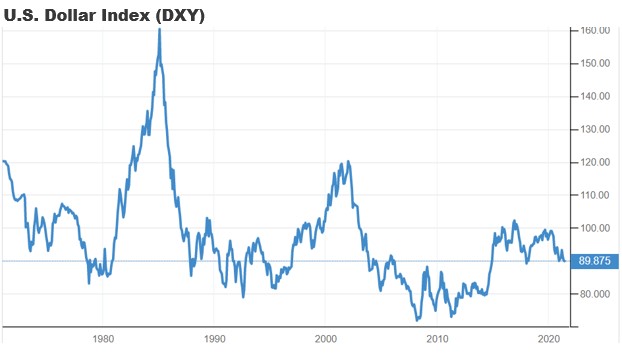

But think in terms of how adding over $35 trillion in debt in such a relatively short period of time could impact the US dollar. The dollar is the world’s reserve currency mainly because markets, financial institutions and investors all over the world believe if they invest in our debt, they will be repaid in full plus interest.

But what if that faith is eroded in the years just ahead? Is there no limit on how much the US can borrow? While it may look like we have a blank check today, history says otherwise. If correct, the long-term implications for the US dollar are grim!

The dollar has been trending lower since the mid-1980s. Each rally has peaked at a lower level. This is a bearish technical picture. The fact that our debt has exploded from $2 trillion to over $28 trillion makes the situation even more grim. Most economists agree that as our debt goes higher, the chances for a strong and lasting economic recovery decrease.

Finally, there is no chance of repaying our national debt in my opinion. At $28+ trillion there is no way we repay it, or even half of it. Plus, we know of no politicians who have any serious plans to repay the debt or reduce it in any meaningful way at this point – and that includes Democrats and Republicans.

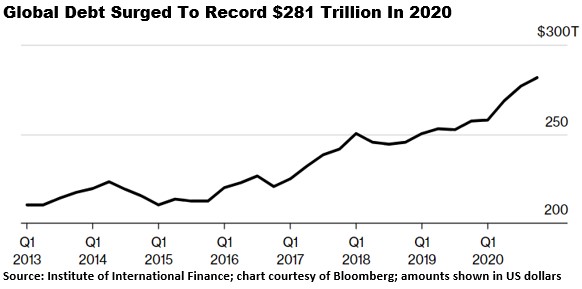

Global Debt Soars To Record $281 Trillion In 2020

As everyone reading this knows, mushrooming debt is not limited to the United States. Governments, corporations and households around the developed world borrowed a record $24 trillion last year to offset the pandemic’s economic toll.

This brought the global debt total to an all-time high of $281 trillion by the end of 2020, or more than 355% of global GDP, according to the Institute of International Finance (IIF). Many of these same countries, companies and households have little choice but to keep borrowing in 2021, according to the IIF and others.

Even as vaccines are rolled out widely, and the global economy begins to recover, governments with big budget deficits are expected to increase debt by another $10 trillion or more this year, as political and social pressures make it hard to curb spending – pushing this group’s debt load past $92 trillion by end-2021, the IIF estimates.

Obviously the most important goal for 2021 will be to find ways to stop borrowing. Both mature and emerging markets will be searching for any kind of balance. While an economic recovery may lead some governments to start developing strategies to roll back stimulus, doing so too soon could magnify bankruptcy risk and defaults. But waiting too long has its own set of risks, chief among them letting the debt continue to grow.

Perhaps the scariest part of all this is the fact there is growing talk in financial circles of a global debt restructuring, also referred to as a debt “jubilee,” where creditors are forced to take a haircut on the amount of debt they are owed.

Unfortunately, that would be the definition of a global financial crisis, if it happens. I’m on it and I’ll keep you posted.

If you notice that when Trump spent money everyone on the press thought it was the worst thing ever. Now Biden is going crazy with spending not one word has been said. Just making a point.