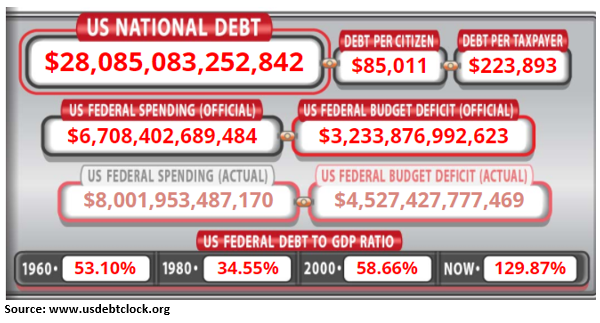

The federal budget deficit for fiscal year 2021 ballooned to $1 trillion in just five months (October – February) – the fastest rise to that level in US history. And that does not include any spending on President Biden’s $1.9 trillion stimulus package passed earlier this month, or the upcoming $3 trillion infrastructure boondoggle the White House is expected to announce any day now.

The budget deficit for FY2019 was $1.1 trillion; then it exploded to a new record of $3.3 trillion in FY2020 according to the Congressional Budget Office (CBO). This fiscal year it is expected to be at least $3.4 trillion – and this estimate may be too low, depending on how much of the $1.9 trillion stimulus and the expected $3 trillion infrastructure spending happens this year.

US debt is clearly out of control and is on track to exceed $30 trillion by the end of this year. Politicians on both sides of the aisle in Washington have thrown all caution to the wind with respect to the national debt. It’s as if people believe we can borrow and spend all the money we want. Yet deep down, I think we all know this movie doesn’t end well in the end.

In case you look it up, the CBO’s official estimate of the US FY2021 budget deficit is currently only $2.3 trillion. However, this projection was last updated in early February, well before President Biden’s $1.9 trillion stimulus bill was passed. The CBO’s next deficit estimate is widely expected to be well north of $3 trillion.

In its long-term forecast, the CBO projects annual budget deficits of $1.2 trillion a year from 2022 to 2031, thus adding an additional $12 trillion to the national debt. But these projections are also probably way too low – unless the bond market revolts – as it certainly will at some point. That’s a different topic for another day.

The “National Debt” Vs. “Debt Held By The Public”

As we hit and exceed the $30 trillion milestone in the national debt later this year, you’ll hear a lot about it in the media, at least temporarily. You’ll hear media pundits arguing the size of our debt doesn’t matter. This is the so-called “Modern Monetary Theory” which contends we can print as much money as we want without negative consequences.

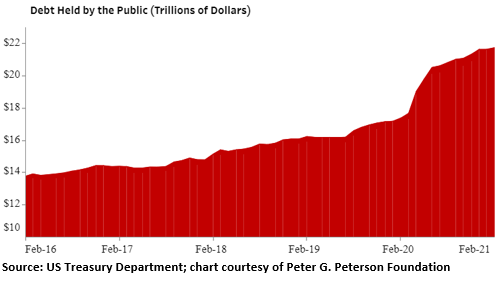

You’ll also hear pundits arguing about the real size of our debt. Many will try to convince you our national debt is not really $30 trillion. They’ll argue that the true size of our national debt is only about $21.5 trillion, which is the current amount of “Debt Held By The Public.”

The other roughly $6.5 trillion is referred to as “Intragovernmental Debt,” which is debt owed by government agencies to one another. For example, let’s say the Defense Department owes the Treasury Department $10 billion it borrowed to develop a new weapons system.

Now there are those on the Left and in the media who argue that Intragovernmental Debt should NOT count as part of our total national debt. They argue this outstanding debt among federal agencies is “money we owe to ourselves” and, in theory, it shouldn’t matter if it’s ever repaid.

I have NEVER AGREED with this theory! To that I say, Ask the Treasury Department if they don’t care if the Defense Department repays the $10 billion it borrowed for the fancy new weapons system. You know the answer to that!

The point is, Intragovernmental Debt has to be repaid at some point, just like other government debt. Those Treasury securities mature at some point and must be rolled over. Likewise, they earn interest just like any other debt.

So there is no reason whatsoever they should not be included in the official national debt. Keep this in mind as we top $30 trillion in the national debt just ahead, when the liberal media will argue that our real national debt is only around $21.5 trillion held by the public, and the other apprx. $6.5 trillion doesn’t count because we owe it to ourselves.

That’s pure hooey! Try teaching your kids to manage their money that way. I don’t think so!!

Sorry, comments are closed for this post.