Older Americans are increasingly ‘unretiring’ to deal with elevated consumer prices and worsening financial positions. According to a recent survey by Paychex, 55% of retirees who went back to work in the last year said they did so because they needed more money.

Most surprising, to me at least, the survey found that 1 in 6 retirees is now considering returning to work after being retired for several years. That’s a big increase.

Over time, the number of older adults in the workforce has been growing. Among adults ages 65 to 74, the workforce participation rate was 25.8% in 2021, according to the US Labor Department. By 2031, that share is expected to grow to 30.7%. In the 75-and-older crowd, the portion still in the workforce was 8.6% in 2021 and is expected to reach 11.1% by 2031.

There are reasons other than needing more money due to inflation which are causing more retirees to return to the workforce. Chief among them is the fact that we are living longer, healthier lives today, and we can work longer.

Another is the fact that many retirees report that they are “bored” in retirement. Over half of respondents to the Paychex survey noted above reported that they were bored or “feeling lonely” in retirement.

I can relate to these concerns personally since I continue to work years beyond the “normal” retirement age of 65. I continue to work because I really enjoy it, and because I know I would be bored out of my mind if I were sitting around the house most days.

Getting back to our topic today, rising costs have turned grocery staples like eggs into luxuries for many people on a fixed budget. Prices were coming down earlier this year, but the latest data signal that elevated inflation is likely to continue.

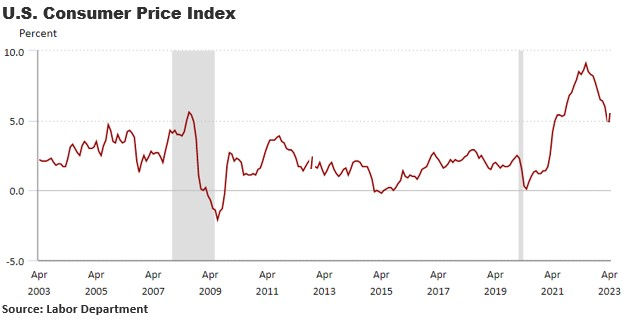

For example, the Consumer Price Index (CPI) rose 4.9% in April from a year prior. This is below the generational high of 9.1% in June 2022 but is still quite high. We’ll have to see if the upward jump in April continues or if prices continue to fall.

Shelter prices were up 0.4% in April from the previous month, with overall housing costs 8.1% higher compared to a year earlier. Shelter, which is responsible for a third of CPI weighting, was a key factor driving CPI higher despite declines in other categories.

An average of 10,000 Baby Boomers reach retirement age each day. Unfortunately, the inflation-driven affordability crisis and the Federal Reserve’s interest rate hikes meant to combat inflation have driven housing costs even higher. This is another big reason retirees are moving back into the labor force at an increasing rate.

Savings and investments should be a cushion for retirees even through difficult periods. Yet many older adults find themselves in deteriorating financial positions due to massive stock market losses in 2022. Some $12.2 trillion in wealth was wiped out as the Dow, S&P 500, and Nasdaq lost 8%, 19.4% and 33%, respectively.

In an AARP survey late last year, more than a third of people 65 and older described their financial situation as worse than a year prior — up from just 13% at the start of the year. While large shares of Americans across age demographics expressed financial struggles, older Americans were more pessimistic about conditions improving for them in the future.

Social Security and Supplemental Security Income (SSI) benefits increased by 8.7% — more than $140 per month — at the start of this year. While that’s a little extra breathing room, the extra social security dollars are not enough to offset rising prices.

On a different note, more people have connected the dots between ill-advised government policies and harsh economic outcomes. Spending nearly $2 trillion dollars on government transfers to nearly every household at a time of supply-chain disruptions and exacerbated labor shortages caused inflation to accelerate. Putin’s invasion of Ukraine and other production disruptions worsened it.

The Biden administration and congressional Democrats passed a climate change bill that they falsely labeled the “Inflation Reduction Act” in hopes of fooling Americans, especially seniors. For many, it didn’t work.

The Democrats’ bill never addressed rising food, housing or energy prices — the most basic and critical needs of households. Furthermore, any climate savings would take years to come to fruition and could be offset by new costs for households – such as tens of thousands of dollars on new electric vehicles we are all expected to buy in the years just ahead.

Let me sum-up today’s discussion this way: The number of retirees deciding to go back to work is increasing. The main reason cited is the need for more income. As noted above, this trend is expected to continue for the next decade, at least.

Rising inflation is the main driver of this trend. While inflation might continue to come down somewhat in the months ahead, the days of 0%-2% inflation are over, in my opinion.